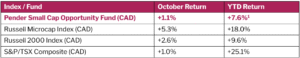

Equity markets continued to advance in October, though gains moderated as investors assessed a busy earnings season amid ongoing macroeconomic uncertainty. The Canadian economy continues to lose momentum, weighed down by trade frictions with the United States. Inflation edged higher during the month, while labour market indicators showed further signs of cooling. In response, the Bank of Canada lowered its benchmark overnight rate by 25 basis points to 2.25% at its October meeting. Despite a more challenging macro backdrop, the S&P/TSX Composite Index has advanced more than 22% YTD, highlighting the resilience of Canadian equities. Commodities delivered another solid month, led by Precious Metals (+3.5% in October) with Gold and Silver up 52% and 69% YTD, respectively. This strength helped offset weaker performance within the energy sector.

Portfolio weights remain roughly 89.1% Canadian equities, 12.2% US equities.

The Fund saw notable contributions from certain Canadian holdings especially in Technology, Industrials and Materials. Navigating today’s macro backdrop requires selectivity. We continue to focus on high-quality businesses trading at reasonable valuations with the ability to compound shareholder value over time.

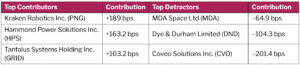

Kraken Robotics was a big contributor in the month on sustained defense spending momentum. The stock also benefited from investor speculation about a potential takeout following Anduril’s acquisition of one of its long-time suppliers2, as well as rising retail interest driven by increased visibility on social media platforms such as X and YouTube.

Hammond Power reported a robust quarter in October with significant backlog growth of ~28%. After several quarters of highlighting robust data centre activity, management noted a meaningful acceleration in data centre orders at quarter-end. These sizable orders accounted for 53% of the third-quarter backlog, underscoring Hammond’s growing exposure to the expanding data centre power infrastructure market.

On the detractor side, Dye & Durham weighed on returns following the withdrawal of a proposed takeover bid by Plantro Ltd., a credit-rating downgrade, and reports that CIBC had stepped back from the sale process, adding to uncertainty amid the company’s ongoing strategic review.

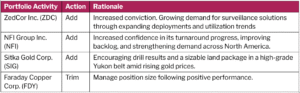

We had an active month in the Fund, exiting a few positions and adding selectively to others as part of our ongoing capital allocation discipline. Some notable additions were: Zedcor and Sitka Gold both of which are now top 10 positions in the Fund.

We had the opportunity to catch up with Zedcor management and believe those discussions reinforce our bullish growth thesis on the story.

Stock Highlight: Hammond Power Solutions

One name of interest this month is Hammond Power Solutions (HPS) the largest North American manufacturer of dry-type transformers—critical components in electrification and energy infrastructure that use air instead of liquid for cooling and insulation. With more than 100 years of operational history, Hammond has evolved from a family-owned enterprise into a global leader in magnetic transformer design and manufacturing.

The company’s business spans three main areas:

- Distribution – transformers for commercial and industrial applications.

- Traditional – serving end markets such as oil & gas, mining, and infrastructure.

- Emerging – renewables, EV charging, semiconductors, and especially data centers.

We believe HPS is positioned at the intersection of several powerful secular trends: grid modernization, renewable energy build-out, and the rapid expansion of power-hungry data centers. These drivers continue to underpin long-term demand for transformers and grid equipment. The company is nearing completion of its $80 million capital expansion program, which will enhance production capacity and efficiency to meet rising demand.

With expanding end-market exposure, pricing discipline, and continued execution on capacity investments, Hammond is likely to remain a high-conviction holding. The stock’s strength reflects growing recognition of its strategic position in enabling North America’s electrification and digital infrastructure build-out.

David Barr, Amar Pandya, and Laura Baker

November 14, 2025

[1] All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Equity Funds may be found here: https://penderfund.com/fund/pender-small-cap-opportunities-fund-2/

[2] Anduril Industries Acquires American Infrared Solutions – October 20, 2025