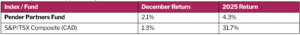

The Pender Partners Fund returned 2.1% in December, bringing YTD performance to +4.3%1. The Fund’s all-cap mandate provides flexibility to pursue mispriced opportunities across market segments and geographies. While broader market conditions appeared relatively stable, performance dispersion remained elevated, with returns driven by a narrow set of market leaders. In this environment, dispersion weighed on the Fund’s results. We view this as a reminder that periods of concentrated leadership can be challenging for diversified, active strategies, but also as the backdrop in which disciplined, bottom-up stock selection has historically created opportunity over time.

Looking back on 2025, the defining market narrative was artificial intelligence. As we enter 2026, however, we believe a broader set of structural forces will increasingly shape markets—many extending well beyond AI alone.

Defense and cybersecurity: Global defense spending is entering a new phase, defined by intelligence, technology, and industrial resilience. As geopolitical tensions persist trillions of dollars in capital are being deployed. This shift represents not only a strategic realignment but also a long-duration investment opportunity, as companies adapt to streamlined procurement processes and rising global demand.

See our latest white paper and watch or listen to our podcast with Retired Admiral Mark Norman for more perspective on this investment theme.

Escalation of capital expenditures: We believe we are in the early stages of a multi-year capital expenditure cycle, driven by automation, data center investment, infrastructure renewal, and the energy transition. Corporations are expected to meaningfully increase spending, both “boots on the ground” and “bytes in the cloud.” A critical and often underappreciated element of this cycle is the need to modernize power grids, which are increasingly strained by electrification, AI-driven data center growth, renewable energy integration, and renewed interest in nuclear power.

Central Bank cutting cycle: More than 45 central banks cut rates at least once in 2025, marking one of the broadest pivots toward easier monetary policy in years, even as inflation remained sticky. What distinguishes this cycle is its motivation: policymakers increasingly prioritized growth and labor market stability over waiting for inflation to fully return to target. In the US, additional cuts remain possible, though leadership changes at the Federal Reserve introduce a new layer of political and policy uncertainty that markets will monitor closely.

Thinking globally: Amid rising political uncertainty in the US, global investors appear increasingly willing to allocate capital to less volatile jurisdictions. Many international markets outperformed US equities in 2025 and, given their valuation discounts, may be positioned to do so again. As the notion of “American exceptionalism” is increasingly questioned, global markets offer a broader opportunity set where fundamentals, balance sheets, and disciplined capital allocation take precedence.

All that glitters: Gold’s extraordinary rally—recently topping US$4,600/oz—has captured widespread attention, with prices reaching all-time highs despite a broadly risk-on market environment. A weaker US dollar, lower interest rates, sticky inflation, and increased central bank reserve buying have propelled both gold and silver to record levels. Investor demand for inflation protection, geopolitical hedging, and diversification has reinforced gold’s role as a strategic asset, with central banks now holding more gold than US Treasuries. That said, recent gains appear driven as much by momentum as fundamentals, suggesting valuations are elevated and volatility may increase.

A potential small-cap reawakening: Small caps have lagged large caps for more than a decade, and the case for mean reversion relative to large-caps remains compelling. Having only recently emerged from a prolonged earnings recession, small caps are now positioned for a return to earnings growth, potentially outpacing large caps in 2026. At the same time, global private equity dry powder remains substantial, with over $2 trillion of uncommitted capital2, suggesting continued M&A interest in public markets. We believe high-quality small caps—those with strong balance sheets, durable competitive advantages, and consistent free cash flow—remain particularly attractive. After a long period of underperformance, 2026 may mark an inflection point for the asset class.

As of month end, the portfolio comprised of 37 holdings with a 48% exposure to US equities and 40.2% exposure to Canadian equities.

In 2025, it was reassuring to see that our strongest contributor was our ownership of the Pender Small Cap Opportunities Fund, reinforcing our conviction in underfollowed, high-quality small-cap businesses. Jabil and Ero Copper remain top ten holdings where our investment theses remain intact. On the detractor side, we exited our position in Molina Healthcare during the year.

David Barr, CFA

January 19, 2026

1 All Pender performance data points are for Class A of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for the Fund may be found here: https://penderfund.com/fund/pender-partners-fund/

2 S&P Global, Private equity dry powder recedes from all-time highs amid slow fundraising