Chers porteurs et porteuses de parts,

Le Fonds alternatif à rendement absolu Pender a affiché un rendement de -0,3 %1 in October, bringing year-to-date returns to 0.7%.

October was a choppier month for markets, with weakness early in the month, a bounce in the middle and a weaker tone late in the month following a hawkish turn from the Fed. The high yield market had its weakest absolute return since April with the ICE BofA US High Yield Index returning 0.2% and spreads finishing 14bp wider at 294bp OAS vs. Govt bonds. The HFRI Credit Index, the Fund’s benchmark returned 0.8% bringing year-to-date returns to 7.8%

Mise à jour sur le marché et le portefeuille

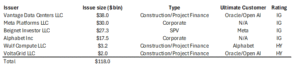

AI’s importance to credit markets increased in October with two new high yield issuers, Wulf Compute LLC and VoltaGrid LLC issuing over $5 billion USD in new bonds to help build out data centers and the power needs associated with them. We participated in Wulf which we believe is the best-in-class high yield AI credit, given a strong backstop from Google once construction is completed. We view Google as a much stronger counterparty than Oracle who is ultimately providing compute to Open AI which has a rather large funding gap in the coming years. AI high yield issuance was dwarfed by financings in investment grade and structured products markets in October, with multiple transactions of greater than $25 billion a piece, including from Special Purpose Vehicles which were a feature of the pre–Global Financial Crisis era, as a way to disguise leverage levels at banks.

Notable announced or completed AI related financings in October

Source: PenderFund research

These are only transactions that were either publicly marketed or traded, as private markets likely funded additional AI related spending.

From our perspective, the market doesn’t differentiate as much as it should between first and second priority debt as well as the quality of the ultimate customer, which is common in bull markets. We believe that Alphabet is a much stronger counterparty than OpenAI, which according to app tracking services has seen declines in daily active users and engagement for ChatGPT’s mobile app2. Unlike the top three hyperscalers, OpenAI has a significant funding gap that will require ongoing capital raises and market confidence in the business growing much larger than its current size in order to fund. Market narratives can shift quickly.

Away from AI issuers, the Fund bought a new issue from Boyd Group Inc. (TSX: BYD) that partially funded the company’s acquisition of JHCC which expanded the it’s footprint into the US. The spread on this five-year issue was in the high 200s, which we believe compares favorably to credits with similar risk profiles in the US market that trade about 100bp tighter on spread.

In October the Fund took some markdowns on a couple of our energy positions, including Vermilion Energy et Saturn Oil and Gas bonds, both of which closed the month about three points below recent highs. While there is real risk to an oversupplied oil market over the near term, we believe that both credits are in good shape to withstand a cycle and we are being well compensated with yields well above the broad high yield market.

Increasing supply and volatility over the past couple of months has increased trading opportunities. We are seeing more dispersion in markets and are surprised that broad indices have held in as well as they have, given the building risks and increasing areas of concern at the individual issuer level.

Perspectives de marché

The volume of AI data center-related issuance in credit markets is unlikely to be sustained. For most of the past couple of months, virtually any transaction or spending announcement was met with a positive initial response from markets. More recently, the question of where the money is going to come from has been asked, and some of the responses haven’t been great. Perhaps the definitive capital spending announcement of the past couple of months was Oracle’s in September which caused its stock to rally about 36% in a day, less than two months later, the stock had given up all of that gain.

While market level credit spreads in high yield would suggest that we are in a benign risk environment, the reality is that below the surface dispersion is noticeably increasing. Some sectors where weakness has increased in recent weeks are Cable and Leisure, with Cable suffering from secular issues and Leisure experiencing cyclical weakness in certain areas.

Seeing some of the most speculative corners of markets peak and roll over in mid-October before broad indices is, we believe, a sign of further weakness to come, rather than a short-term blip. We would not expect any repricing of the market to be linear as there will be positive seasonal factors at play between now and the end of the year. However, we believe it’s important not to get carried away and try to chase this market. Valuations are high, volatility has been low, and we believe there are several signals that argue we are relatively late in an economic cycle.

Paramètres du portefeuille

The Fund finished October with long positions of 119.7% (excluding cash and T-bills). 30.6% of these positions are in our Current Income strategy, 86.6% in Relative Value and 2.4% in Event Driven positions. The Fund had a -66.7% short exposure that included -3.6% in government bonds, -40.2% in credit and -22.9% in equities. The Option Adjusted Duration was 1.51 years.

En excluant les positions se négociant à des écarts de plus de 500 pb et les participations se négociant en vertu d’une date d’échéance ou de rappel de 2027 ou antérieure, l’OAD du Fonds a baissé à 0,99 an.

The Fund’s current yield was 5.96% while yield to maturity was 6.44%.

Justin Jacobsen, CFA

10 Novembre 2025

[1] All Pender performance data points are for Class F of the Fund unless otherwise stated. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Liquid Alternative Funds may be found here: penderfund.com

[2] TechCrunch - ChatGPT’s mobile app is seeing slowing download growth and daily use, analysis shows - October 17, 2025