Market Environment – AI from Narrative to Numbers

At the start of 2026, investors entered the year with a mix of optimism and uncertainty. While outlooks were published and geopolitical risks remained elevated, one theme continued to shape market narratives and investor focus: artificial intelligence.

As the “Magnificent Seven” report earnings, AI-related themes were increasingly supported by hard data. Rather than signaling speculative excess, results reflected real demand, accelerating usage, and expanding monetization, albeit alongside rising capital intensity. We are increasingly seeing how AI is directly influencing capital allocation decisions across the world’s largest technology platforms.

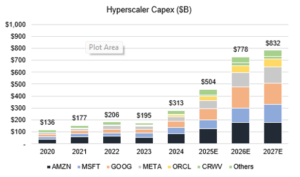

Alphabet, Meta, Microsoft, and Apple all delivered results that highlighted both the opportunities and trade-offs of the current AI cycle. Alphabet demonstrated resilience across Search, YouTube, and Cloud, with AI contributing across multiple business lines while margins proved resilient despite elevated investment. In 2026, Google estimated capital spending to be in the range of $175 billion to $185 billion, up roughly double year-over-year, soaring above street estimates, with most of its capital spending going toward artificial intelligence cloud infrastructure. As CEO Sundar Pichai noted, “We’re seeing our AI investments and infrastructure drive revenue and growth across the board”. Meta delivered one of the clearest examples of AI leverage, with improved ad targeting driving higher engagement and conversion, supporting increased forward capital spending.

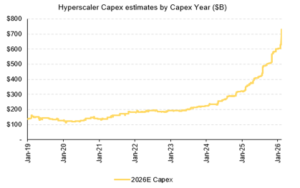

Taken together, these results highlight the scale of investment required to support AI growth. Hyperscaler capital expenditure expectations continue to move higher as enterprise adoption accelerates. Increasingly, power availability, data center development, and grid infrastructure are emerging as gating factors, pulling energy, utilities, and enabling infrastructure further upstream in the AI value chain. This highlights an important distinction between AI adopters such as Meta, Alphabet, and Amazon and AI infrastructure providers. The latter includes semiconductor manufacturers, data center hardware suppliers, and power and grid infrastructure companies who are benefitting from the rising capital spend. We own several businesses leveraged to this theme.

Hyperscaler Capex

Source: S&P Capital IQ

We believe the takeaway from January is that AI is no longer a future concept, it is a present economic force. While expectations remain elevated and market concentration has increased, the path forward increasingly favors selectivity, valuation discipline, and a focus on durable business models, an approach we believe is well suited to our investment framework.

Fund Specific Updates

Webster Financial (WBS) announced in early February that it has entered into an agreement to be acquired by Banco Santander in a cash-and-stock transaction. Under the terms of the deal, shareholders will receive ~$75.59/sh, a 16% premium to Webster’s 10-day volume-weighted average price. Importantly, this marks the second M&A transaction in the Fund over the past month, following SoftBank’s announced acquisition of DigitalBridge on December 29.

Hexcel (HXL) a leading supplier of advanced composite materials for aerospace and defence reported Q4 results modestly ahead of expectations. More importantly, management’s 2026 outlook pointed to a meaningful improvement, with guidance calling for approximately 10% organic revenue growth and 25% EPS growth. Following a challenging 2025, Hexcel is beginning to benefit from production ramps at Airbus and Boeing, with industry destocking largely complete. As OEM production increases over the next few years, the company expects to generate roughly $500 million in incremental annual sales from sole-source contracts, with an additional $200+ million supported by growth across defense, space, and business and regional jets.

Deckers Outdoor (DECK) reported fiscal Q3 results that exceeded expectations and raised revenue growth guidance for its two core franchises, UGG and HOKA. Management continues to execute effectively by carefully managing inventory levels in the wholesale channel, supporting strong sell-through and pricing discipline. The company delivered record quarterly revenue and profit, driven by balanced growth across both direct-to-consumer and wholesale channels, continued brand momentum, and international expansion. We expect HOKA to continue gaining market share in its core categories as new customers are acquired and existing enthusiasts deepen their engagement with the brand.

Another notable update came from Modine Manufacturing (MOD), which announced the spin-off and merger of its Performance Technologies business. This transaction reinforced our view of management’s disciplined capital allocation, following several divestitures completed at attractive valuations to reinvest in higher-growth, higher-return opportunities. Additionally, Modine meaningfully raised its data center product sales outlook for fiscal 2028 to approximately $2.3–$3.0 billion, up from $2.0 billion previously, implying a 50–70% CAGR over the next two years, supported by a strong backlog and order pipeline.

We added one new holding this month, Generac Holdings (GNRC), an industrial company that designs, manufactures, and sells power generation equipment and other energy technology solutions. Generac is best known as a leading manufacturer of home standby and portable generators. A key component of our investment thesis is that Generac is well positioned to benefit from rising power demand driven by data center growth, given the need for highly reliable, redundant power infrastructure. In addition, a return to more typical storm activity and related electricity outages, following an unusually low level of storm activity in 2025, should support a recovery in Generac’s high-margin retail backup power business.

Aman Budhwar, CFA

February 11, 2026

1 All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Equity Funds may be found here: https://penderfund.com/fund/pender-us-small-mid-cap-equity-fund/.