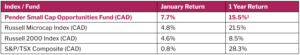

In January, the Fund delivered a return of 7.7%, representing a positive start to the year. The Fund outperformed both Canadian and US equity markets, with the S&P/TSX Composite Index gaining 0.8% and the Russell 2000 Index (CAD) rising 4.6%. The muted performance of the TSX was partly driven by declines in commodity prices, particularly precious metals, which weighed on resource-heavy sectors. Canadian equities were also affected by spillover volatility from US markets tied to political uncertainty. Despite these late-month pressures, gains earlier in January allowed Canadian equities to finish the month in positive territory.

Our investment approach continues to be anchored around four transformative themes that we believe will shape markets and drive long-term returns: Artificial Intelligence, Energy Transition, Enterprise Software, and Geopolitics.

In recent weeks, the rapid advancement and adoption of AI has remained top of mind for investors. The recent selloff in the software sector has been meaningful and, in our view, largely reflects multiple compression and uncertainty around the pace and direction of technological disruption, rather than a broad-based deterioration in underlying fundamentals.

From a portfolio perspective, we are actively managing both risk and exposure. We have been deliberate in reassessing position sizes, balance sheet resilience, and near-term cash flow durability, while ensuring aggregate portfolio exposure remains aligned with our risk tolerance under more conservative valuation assumptions.

At the same time, rapidly evolving technologies such as AI are unlocking new efficiencies, strengthening competitive moats, and creating outsized long-term growth opportunities. The current dislocation has created opportunity, and our investment process is focused on identifying platforms with durable customer relationships, low churn, and clear pathways to compounding free cash flow per share through the cycle.

Portfolio weights remain predominantly Canadian, with approximately 83.4% in Canadian equities and 15% in US equities.

Portfolio Holdings - Updates

5N Plus Inc. also delivered a strong month. The company is a global leader in specialty semiconductors and performance materials, supplying critical inputs for renewable energy, space-based solar cells, medical imaging, and high-purity metals used in pharmaceutical and industrial applications. In late 2025, 5N Plus was added to the S&P/TSX Composite Index, enhancing its investment profile. More recently, the company received a US $18.1 million US government grant to support defense and space supply chains and announced plans to expand space solar cell production capacity by 25% in 2026 to meet growing demand from satellite and AI-related markets.

A top contributor this month was General Fusion (private). The company announced plans to go public via a SPAC merger with Spring Valley Acquisition Corp. III, targeting a mid-2026 close and a Nasdaq listing under the ticker GFUZ. Proceeds from the transaction are expected to fund development of its LM26 demonstration machine. As a pioneer in fusion energy, General Fusion illustrates our long-term focus on the energy transition and the need to meet rising power demand driven by AI and digital infrastructure.

Despite recent share price appreciation, our investment thesis remains intact, supported by multiple growth catalysts. Recent developments reinforce our view that 5N Plus is a critically important supplier of strategic materials to the Western world. Looking ahead, we see potential for additional investment from US, Canadian, and European governments as these regions continue to re-shore production and strengthen supply chains for critical materials.

On the detractor side, TerraVest Industries Inc. shares declined nearly 20% during the month, despite limited incremental news beyond the acquisition of steel and fiberglass tank OEM KBK Industries on January 9, a transaction that was generally well received by analysts.

The broader software selloff weighed on several holdings in the portfolio during the period. PAR Technology Corporation was pressured by the pullback, despite announcing the acquisition of Bridg, an identity resolution platform for $27.5 million. While modest in size, the acquisition is strategically aligned with PAR’s data strategy, enhancing the platform’s ability to identify and engage non-loyalty customers from previously anonymous transactions. Despite the recent selloff, we continue to view PAR as a high-quality business, and our thesis is unchanged.

Outlook

While the near-term backdrop for software remains volatile, we view this environment as increasingly attractive for selective, long-term investment. Market dislocations are creating compelling opportunities to invest in high-quality software businesses at valuations that better reflect underlying fundamentals rather than narrative-driven expectations. As investor focus continues to shift away from price-to-sales multiples toward durable free cash flow generation, we are increasingly excited about the opportunity set for disciplined investors.

We are actively revisiting our valuation scenarios with a heightened focus on downside resilience, stress-testing margins and cash flows under more conservative assumptions. Importantly, many of the businesses we follow continue to demonstrate strong strategic relevance, sticky customer relationships, and improving operating leverage. In this environment, our private equity–inspired valuation framework, grounded in sustainable free cash flow and long-term strategic value, positions the portfolio to capitalize on mispricings while laying the foundation for enhanced long-term returns.

David Barr, CFA and Amar Pandya, CFA

February 12, 2026

1 All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for the Fund may be found here: https://penderfund.com/fund/pender-small-cap-opportunities-fund/