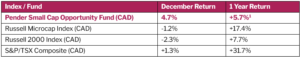

As we begin 2026, it is worth reflecting on the forces that shaped markets over the past year. Resilience emerged as the defining theme, with equities largely shrugging off ongoing geopolitical and economic uncertainty. In many ways, 2025 felt like a long ski day with constantly changing conditions — smooth, packed powder one run, followed by unexpected ice and moguls the next.

Early in the year, conditions were challenging. In the first quarter, the Russell 2000 declined about 10% following the announcement of a new tariff regime, and that weakness carried through small-cap markets more broadly. The second quarter brought a strong rebound as confidence improved. The third quarter was more challenging, as market leadership skewed toward more speculative areas of the small-cap universe, creating a tougher environment for fundamentally driven strategies. More recently, conditions have begun to smooth out, with a rotation back toward higher-quality growth companies and more normalized performance.

Overall, it’s been a year where staying balanced, picking your line carefully, and focusing on the long-term has mattered more than reacting to every bump along the way.

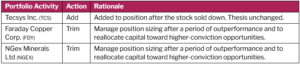

Portfolio weights remain predominantly Canadian, with approximately 86% in Canadian equities and 14% in US equities.

Portfolio Holdings - Updates

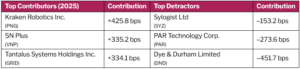

2025 was a year of significant dispersion. The Fund’s top performers delivered robust results and remain core positions, continuing to rank among the top ten holdings. Importantly, each of these companies is aligned with key secular themes that we expect to come into sharper focus in 2026.

- Kraken Robotics designs and manufactures advanced subsea robotics, sonar systems, and batteries used in autonomous underwater vehicles for defense, offshore energy, and infrastructure applications. It is positioned to benefit from heightened geopolitical tensions and increased global defense spending, particularly in undersea and autonomous systems.

- 5N Plus develops, manufactures, and distributes specialty semiconductor and performance materials critical to industries tied to the energy transition and defense, including solar, space, and advanced electronics.

- Tantalus Systems operates in the grid optimization and modernization market, providing smart meters and data analytics software that help utilities modernize infrastructure and support the energy transition through improved grid efficiency.

On the detractor side, Sylogist, PAR , and Dye & Durham weighed on performance during the year, primarily due to company-specific execution challenges and elevated near-term investor uncertainty, rather than a deterioration in long-term fundamentals.

Outlook

After several years of small-cap underperformance relative to large caps in Canada, the slope now appears to be leveling out. Over the past five years, the S&P/TSX SmallCap Index has meaningfully lagged the S&P/TSX Composite, driven by higher interest rates, risk aversion, and a narrow concentration of returns in large-cap financials, energy, and materials. From our perspective, this has created a more attractive opportunity set for both small-cap quality and value heading into 2026.

In 2025, Canadian equity returns were largely driven by mining and materials companies, along with businesses benefiting from the AI investment cycle — often indirectly through infrastructure, energy, or capital spending. At the same time, many high-quality Canadian businesses with durable margins, consistent free cash flow, modest growth, and strong balance sheets were overlooked, despite trading at valuations we view as compelling. This is the part of the market where we tend to spend our time, and where we believe the risk-reward has quietly improved.

Looking ahead, several factors could support Canadian small caps, including the gradual commercialization of AI, the potential for lower interest rates, and increased M&A activity given the valuation gap between public and private markets. While uncertainty remains elevated, we don’t believe that successfully investing requires predicting every macro outcome or market turn.

So where do we go from here? The path forward feels less predictable than the terrain behind us. There is no shortage of potential risks, from geopolitics and elevated debt levels to political uncertainty and rapid technological change. Rather than trying to forecast every turn, we remain focused on staying balanced and disciplined. We believe that a portfolio of well-managed, competitively advantaged Canadian businesses, trading at sensible valuations can generate compelling returns over the coming quarters and years. Importantly, quality businesses have historically held up better than the broader market when conditions become more challenging.

David Barr, CFA and Amar Pandya, CFA

January 13, 2026

1 All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for the Fund may be found here: https://penderfund.com/fund/pender-small-cap-opportunities-fund/.