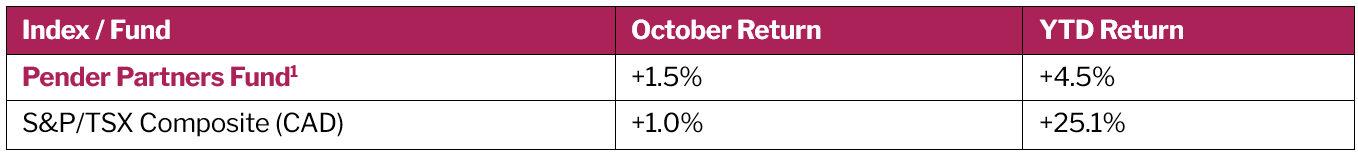

The Pender Partners Fund gained 1.5% in October and 4.5% YTD. The Fund’s all-cap mandate provides the flexibility to capture opportunities across market segments and geographies. As of quarter end, the portfolio comprised of 35 holdings with a 44.8% exposure to US equities and 42.1% exposure to Canadian equities. Top holdings are within Industrials, Technology and Financial Services which together account for nearly 50% of sector exposure.

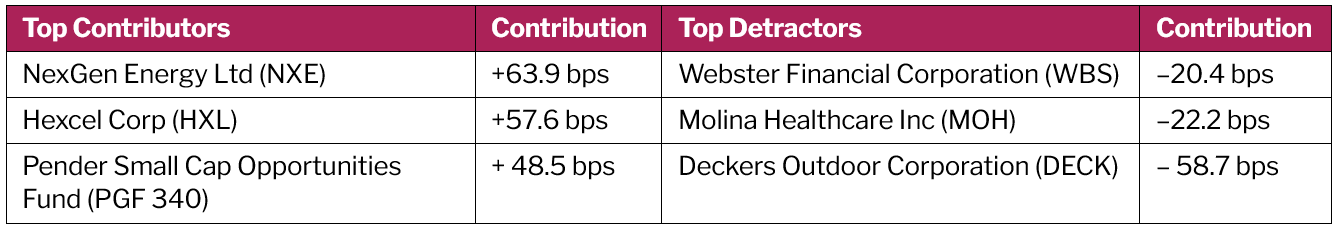

The top Fund contributor in October was NexGen Energy, as its ~C$1 billion equity financing materially reduced funding risk for the Rook I project. With the company now effectively fully funded and approaching key permitting milestones, the stock re-rated higher on improved visibility and reduced execution risk. We continue to follow the strengthening uranium cycle, supported by tight supply, rising utility demand, and growing interest in nuclear energy. Other notable movers included Hexcel Corp, a leading US industrial materials company specializing in advanced lightweight composites such as carbon fiber, fabrics, and resins. The company reported quarterly earnings that were slightly ahead of consensus, and we believe Hexcel remains well positioned to benefit from strengthening investor confidence in the original equipment cycle and the expected ~50% increase in widebody revenues over the 2026–2028 period. Finally, the position in the Pender Small Cap Opportunities Fund added to performance by providing exposure to undervalued Canadian small caps, reinforcing the Fund’s bottom-up value orientation. Our USD cash positions also contributed positively, as the CAD weakened against the USD amid widening interest-rate differentials and soft Canadian economic data. The strengthening USD increased the value of these holdings when translated back into CAD, boosting overall performance.

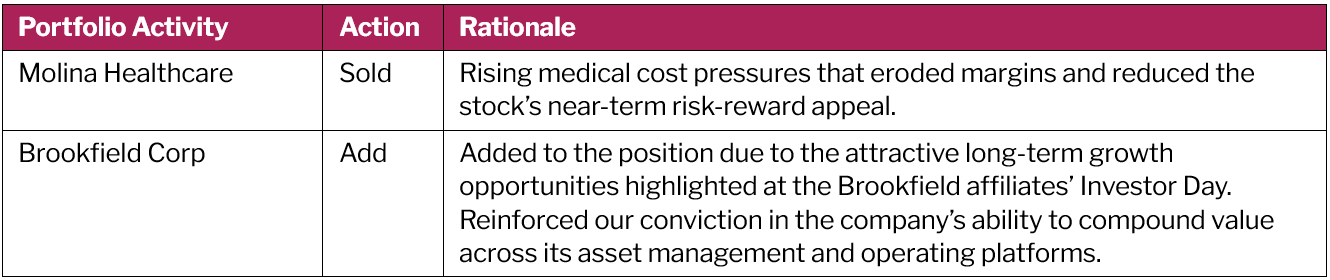

Weaker performers included Molina Healthcare, which we exited during the month due to a less favourable operating environment. As a low-cost, Medicaid-focused managed care organization, Molina is particularly exposed to rising medical costs and ongoing regulatory pressures. Deckers was also a detractor despite reporting solid quarterly results, as full-year guidance came in softer than expected. Management cited a more cautious US consumer, tariff-driven cost increases, and the risk of slowing growth and tightening margins.

Market Environment - “The Calm Before (or During?) the Storm”

Reporting live from your local weather station: October arrived with the kind of clear blue skies that make equity investors uneasy, too perfect, too calm, too good to last. Markets drifted toward new highs under these tranquil conditions, even as storm systems—rising stress in private credit, housing-market weakness, and tightening pockets of financial conditions—quietly gathered on the horizon. It felt like one of those rare autumn days in Vancouver when the sky is pure blue, yet the familiar rain showers remind you that … winter is coming.

Earnings releases this month served as the first gusts of that change. We analyzed our portfolio companies’ quarterly results as they moved into our atmosphere – their own micro-weather events. Some brought sunshine in the form of solid revenue trends and margin resilience, others brought clouds of cautious guidance revealing softer demand or renewed cost pressures. With valuations sitting at the upper end of historical ranges, markets are increasingly sensitive to these updates. In many cases, “good” results simply weren’t enough; companies needed exceptional execution or compelling forward commentary to sustain the upward momentum.

The macro environment remains a persistent storm cloud on the horizon. Inflation has moderated but remains sticky in key areas, keeping central banks in a holding pattern. Labour markets are cooling, though still tight by historical standards. Consumer spending continues, but early signs of fatigue, especially among lower-income households, are becoming more apparent. Meanwhile, corporate balance sheets, strengthened by years of low-rate refinancing, remain generally healthy, and the surge in AI-driven investment continues to act as an effective tailwind for technology providers and related sectors. This mix of forces has kept markets buoyant but also broadened the range of potential outcomes heading into year-end.

Looking ahead, we remain alert to storms that could break this seasonally uncharacteristic calm. Historically, the most consequential market events are those not yet in the conversation—the “unforecasted fronts” that develop quietly before arriving suddenly. A sharper-than-expected slowdown in consumer activity, a credit dislocation within private markets, geopolitical flare-ups, or the delayed effects of restrictive monetary policy could all shift the weather pattern rapidly.

It has been a surprisingly positive year for investors, with markets exhibiting resilience that few would have predicted at the start of 2024. Still, the final months will determine how durable this fair-weather season proves to be—and whether the current calm marks the beginning of a stable high-pressure system or simply a pause between storms.

David Barr, CFA

November 18, 2025

1 All Pender performance data points are for Class A of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Equity Funds may be found here: https://penderfund.com/fund/pender-partners-fund/