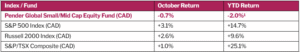

As we enter the final two months of the year, there has been no shortage of excitement for investors. The month began with a US government shutdown, which has now ended after becoming the longest in history at 43 days. Despite this headline risk, corporate earnings have been robust — with 64% of S&P 500 companies having reported Q3 2025 results, showing year-over-year earnings growth of +10.7%, well above the expected +7.9%. Consensus estimates now call for earnings to rise +11% in 2025 and +14% in 2026. The S&P 500 reached a new all-time closing high of 6,891 on October 28, marking its 36th record close of the year. Yet, beneath the surface of this rally, there are growing signs of froth— including renewed interest in meme stocks and SPACs, stretched valuations, record options activity, and record-high margin debt.

The “Magnificent 7” stocks have continued to dominate market leadership, far outpacing traditional “old economy” sectors. Capital expenditures by major technology companies — Microsoft, Google, Meta, and Amazon — are projected to exceed $450 billion in 2026, largely directed toward expanding data centers, cloud infrastructure, and AI computing capacity. Small-cap stocks moderated following their strong Q3 performance, posting mixed results in October, while mid-caps finished slightly negative. Foreign developed markets trailed the US for the month but remain ahead YTD. Emerging markets continued to outperform, rising +4.2% in October and +32.9% YTD.

Portfolio weights remain roughly 68.2% Canadian equities and 31.0% US equities. The Fund saw notable contributions from certain holdings especially in Technology, Industrials and Materials.

Fund specific updates

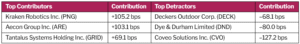

Although the Fund underperformed indices in October, we remain confident in our strategy. In a challenging macro environment, we are focused on high-quality businesses trading at reasonable valuations and capable of compounding value over time. We continue to see attractive opportunities in our holdings.

Kraken Robotics was a big contributor in the month on sustained defense spending momentum. The stock also benefited from investor speculation about a potential takeout following Anduril’s acquisition of one of its long-time suppliers, as well as rising retail interest driven by increased visibility on social media platforms such as X and YouTube.

Tantalus Systems was a positive contributor during the month, with shares rising ~ 30%. The company provides smart-grid technology solutions that help utilities modernize and optimize their distribution networks. We believe Tantalus is well-positioned to benefit from long-term structural trends such as electrification, grid resilience, renewable integration, and increased infrastructure investment. Supported by secular growth drivers that are largely independent of broader economic cycles, GRID remains a core holding in the Fund.

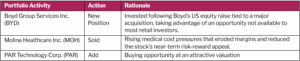

We initiated a new position in Boyd Group Services in the month following the company’s announcement of the US$1.3 billion acquisition of Joe Hudson’s Collision Center, a 258-location multi-shop operator with a strong market presence across southeast America. To support the transaction, Boyd completed a US$897 million bought-deal US IPO, issuing 6.36 million shares at US$141/sh. The acquisition was struck at an attractive 9.3× EBITDA multiple post-synergies and is expected to be immediately accretive providing an attractive investment opportunity.

We decided to sell our position in Molina Healthcare during the month due to a less favorable operating environment. Molina operates as a low-cost, Medicaid-focused managed care organization, making it particularly exposed to rising medical costs and ongoing regulatory pressures.

Stock Highlight: PAR Technology

PAR is a global provider of food service technology solutions that help restaurant and retail brands streamline operations and enhance guest experiences. Its unified, open platform integrates point-of-sale, digital ordering, loyalty, back-office, payments, and hardware systems to support scalable growth.

Our investment thesis is that PAR is well-positioned for long-term value creation through accelerating growth and expanding margins. Its unified commerce platform strategy, expanding total addressable market, and strong leadership underpin a constructive outlook. In our view, the company’s competitive positioning is reinforced by high switching costs, a fully integrated product suite, an extensive ecosystem of third-party integrations, and deep domain expertise.

We continue to monitor key catalysts, including competitive wins, international expansion, strategic M&A, and margin improvement.

David Barr

November 17, 2025

1 All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Equity Funds may be found here: https://penderfund.com/fund/pender-global-small-mid-cap-equity-fund/.