Dear Unitholders,

The Pender Alternative Absolute Return Fund returned 0.0%1 in September, bringing year to date returns to 1.0%.

September saw robust risk appetite met with record high yield issuance. The ICE BofA US High Yield Index returned 0.8%, despite giving up some gains in the last week of the month. Spreads tightened by only 4bp in the month to finish at 280bp Gov’t OAS. The HFRI Credit Index returned 1.5% bringing year to date returns to 7.6%.

Portfolio & Market Update

Based on Bank of America data, there was $58.3 billion of issuance in the US high yield market in September, surpassing March 2021 and setting a record for monthly issuance. Late in the month, the weight of this supply caused a modest weakening of the market which is still among the most expensive markets of the past twenty-five years. Despite the record issuance in US high yield, we found limited opportunities to participate in new issues. Many issues priced right at our estimate of fair value, without any new issue concession resulting in mixed performance and plenty of transactions trading below issue price by the end of the month.

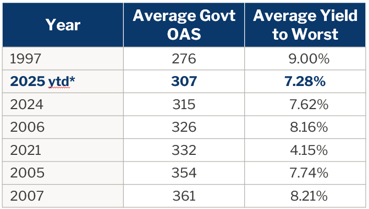

The past six months have been the most challenging period for the Fund in the four years since inception. An expensive market which grinds higher with very little volatility is a difficult environment for us to add value. We believe that using valuations and fundamentals to guide positioning will serve us well through the cycle. So far, the year 2025 has seen the lowest average spread for the high yield market since 1997, when base rates were materially higher.

Source: ICE BofA US High Yield Index Spread, as of Oct 6, 2025

Momentum has been working as a market theme but investors who invest into a trend-following strategy will be natural sellers when the market does turn, increasing volatility. While high yield supply is reminiscent of early 2021, so is speculation in certain retail dominated corners of equity markets. Per the table above, despite spreads being tight, the all in yields make credit markets more attractive than they were in 2021, where the combination of low base yields and low spreads had no precedent, and may never be repeated.

There are growing concerns in several sectors of high yield, notably consumer financials, autos and chemicals. The First Brands and Tricolor bankruptcies have been rippling through leveraged credit markets, with delayed negative impacts on institutions as exposures become clearer. We suspect there may likely be further credit surprises going forward although this might be the extent of it in automotive finance for now. We generally have a cautious view on autos, with our primary long position having a hedge in the same capital structure. There are some crossover investment grade and high yield credits like Ford and Nissan where we believe the market has underpriced risk.

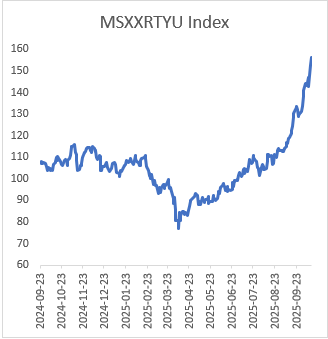

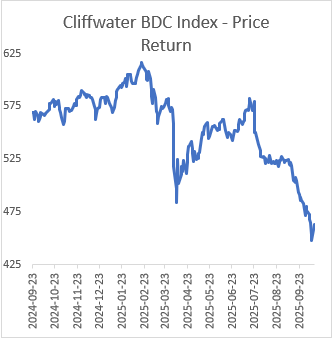

Credit and equities are showing clear signs of divergence over the past few months. With lower quality pockets of equity markets rallying sharply at the same time that some riskier pockets of credit have seen clear risk aversion. We believe this divergence isn’t sustainable, and, in our experience, credit is more likely to be a leading indicator than equities.

| Morgan Stanely’s basket of unprofitable companies in the Russell 2000 Index | Cliffwater BDC Index |

| Source: Bloomberg | Source: Bloomberg |

Publicly traded BDCs are effectively closed-end private debt funds. While the managers of these BDCs argue that the decline in prices does not reflect a decline in Net Asset Value, the combination of expectations of lower policy rates and recent bankruptcies of some larger, lower quality credits have been driving concerns about the private debt market. With the spectacular growth of private debt assets under management and the lack of a true credit cycle since the market reached its current size, it stands to reason that we can expect some fairly wide divergences between lower and higher quality managers in the coming years. Several real estate exposed funds in Canada have recently gated investors, which is an indication that the credit cycle may be peaking.

Market Outlook

One of the primary drivers of market sentiment in recent weeks has been the announcements of large data center and chip transactions relating to the build out of AI in the coming years. Several of these transactions have been circular in nature. While we have seen several news articles suggesting that circular financing raises investor concerns, the market response has been optimistic with several large rallies in the equities of companies announcing transactions.

It is unclear whether the vast amount of capital being deployed into AI will end up being allocated well. Bain estimated a couple months ago that $2 trillion in revenues by 2030 are needed to justify the planned capital expenditures, with all the announcements since, that estimate should be higher now. According to the Wall Street Journal, that $2 trillion figure is more than five times the total global subscription software market today, while Morgan Stanely estimated that AI products generated $45 billion in revenue in 2024.

While the growth of consumer subscriptions for OpenAI’s products has been impressive, the adoption of AI by enterprises has been much more mixed. According to MIT researchers, 95% of enterprise pilot AI projects are scrapped without any return on the investment. A recent Bloomberg report cited research from Stanford and Harvard that some AI applications are actually counter productive to productivity because the outputs amount to “workslop”.

If AI’s capital expenditures far exceed the business case for them it may be reminiscent of major technological advancements like the build out of fiber to handle internet traffic in the late 1990 and early 2000s. If this proves to be the case, the aftermath for capital markets would unlikely be pretty. We have seen credit markets increasingly used to fund the AI buildout with investment grade and private debt markets funding several large data centers. Oracle Corp. (ORCL) issued $18 billion in investment grade bonds last month to help support their build out, the second largest IG transaction of 2025. Terawulf Inc. (WULF) is issuing $3.2 billion in high yield bonds to fund a data center via a new subsidiary with a backstop from Alphabet Inc. (GOOG), adding a third AI focused issuer to the high yield market in 2025 after Coreweave Inc. (CRWV) and X.AI LLC (private). None of these issuers had issued high yield bonds at the start of the year. We expect credit markets exposure to AI to continue to grow in the coming months.

Both record high yield issuance and a new record for the largest leveraged buyout, surpassing a 2007 record are indicative of a late cycle environment. The music stopping may not be immanent, but we interpret these data points as indicators that we are in the later innings. The parabolic move reminiscent of the meme stock era of unprofitable companies in the Russell 2000 index may imply that in the near term we could see volatility pick up, as overbought markets usually don’t move sideways once the rally ends.

Portfolio Metrics

The Fund finished September with long positions of 122.3% (excluding cash and T-bills). 29.3% of these positions are in our Current Income strategy, 89.9% in Relative Value and 3.1% in Event Driven positions. The Fund had a -65.1% short exposure that included –3.5% in government bonds, -39.6% in credit and –22.0% in equities. The Option Adjusted Duration was 1.79 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2027 and earlier, Option Adjusted Duration declined to 1.29 years.

The Fund’s current yield was 6.18% while yield to maturity was 6.68%.

Justin Jacobsen, CFA

October 20, 2025

[1] All Pender performance data points are for Class F of the Fund unless otherwise stated. Other classes are available. Fees and performance may differ in those other classes.