Dear Unitholders,

The Pender Alternative Absolute Return Fund returned 0.7%1 in November, bringing year to date returns to 1.7%.

Market volatility picked up in November, driven by high issuance and concern around the business models of certain segments of the AI industry. A strong final week supported by US Thanksgiving and limited investor engagement allowed the high yield market to put up yet another positive month, with the ICE BofA US High Yield Index returning 0.5%. Spreads finished the month roughly flat at 292bp OAS vs. Govt after widening to 320bp in the middle of the month. The HFRI Credit Index, the Fund’s benchmark returned 0.0% in November, bringing year to date return to 7.8%.

Portfolio & Market Update

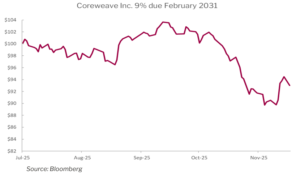

Volatility resulted in increased trading opportunities for the Fund in November. We established a position in a new AI datacenter issuer, Cipher Compute LLC, a subsidiary of Cipher Mining Inc (Nasdaq: CIFR) much like our position in Wulf Compute LLC (Nasdaq: WULF), Cipher has a backstop from Google once the data center they are building is up and running. We are effectively underwriting construction risk which we believe is manageable. We view these two holdings as the best value across AI data center credits, including investment grade issues. We were able to add to both positions in November at yields of about 7% for five-year terms with amortization features once the facilities are constructed. The credit spread for 5-year Alphabet Inc bonds is about 30 basis points, for a yield to maturity of just over 4%. Further out the risk curve, CoreWeave which has the distinction of being the first AI credit to come to the high yield market earlier this year, has seen a very significant re-rating of its credit risk profile. After trading at about an 8% yield earlier this fall, their 9% 2031 bond reached about a 12% yield in late November, before bouncing in early December. The business models of “neoclouds” are coming under increasing scrutiny, relating to margins, amortization periods, leverage and potential for overbuilding. There has been significant insider selling of CoreWeave’s shares in recent months. We do not have a position in the company’s bonds but believe they are a useful data point for AI risk sentiment.

Beyond CoreWeave’s performance, credit markets have started to differentiate between AI data center credits. The basis between the first lien, Google backstopped issues we own and second lien Voltagrid which is a ‘behind the meter’ power provider to an Oracle and ultimately an OpenAI data center started to widen late in the month, but we believe the basis has room to widen further and is not at fair value. We suspect that there could be a substantial re-rating of data center credit risk generally in the coming months and are sticking to only the highest quality credits for now.

Source: Bloomberg, Yield to Worst (YTW) of Wulf Compute LLC 7.75% 2030 relative to Voltagrid LLC 7.375% 2030

In a benign credit environment, the basis between first and second lien bonds for high quality issuers like Restaurant Brands International has often been about 50bp, and in this case we believe there is a significant difference in credit quality between the two issuers in addition to a structural first versus second lien basis.

In November, the Fund’s Parkland Inc. holdings were exchanged for new Sunoco LP (SUN) bonds following the merger of the two companies. Our largest holding in the structure remains the 6% Canadian Dollar denominated bonds due in June 2028, this issue is callable at par with 10 days’ notice. We estimate that a non-callable bond with the same maturity date would trade at a yield to maturity of about 4.5% and therefore we enjoy a significant margin of safety for this Current Income position in the Fund.

The Fund has had several bonds called in recent weeks including MEG Energy Corp. (MEG)’s 2029 issue following its acquisition by Cenovus, Shelf Drilling following its acquisition by Ades Holding Co, and Mattamy Group Corp which tapped the Canadian and US high yield markets to term out their near-term maturities with longer term bonds at historically tight spreads in early December.

Following a strong earnings report and a rally in the company’s bonds we sold some of our Vermilion Energy Inc. (VET) bond holdings in November. While the Fund has a large energy exposure, much of this is held in money market securities of investment grade midstream companies, and Sunoco which is primarily a retail gasoline business. Many of the Fund’s holdings are shorter duration, higher quality and in Canadian dollars which tend to be lower beta. We have relatively little exposure to USD securities which are highly sensitive to commodity prices and energy sentiment, just Vermilion and Saturn Oil & Gas Inc. (SOIL), both of which are about 1% weights in the Fund.

Market Outlook

The strong rebound in sentiment and asset prices in late November and early December belies some fundamental shifts in market narratives. In September, any AI spending announcement was viewed positively by markets. Sentiment has now shifted significantly, as skepticism about the business models for both data centers and AI software businesses has risen. Now that credit markets are involved in AI and have identified and attached significant risk premiums to data centers, in particular neo clouds, we believe that the euphoria of a few months ago is unlikely to return.

With a new year just weeks away, many investors’ timelines are about to be extended from year-end 2025 to year-end 2026. Early January can often be a quiet period in markets where low engagement and inflows into risk assets can produce solid short-term returns. This is not always the case as in early 2022 treasury bonds sold off sharply on no news, presumably driven by the extension of time frames with a new calendar year.

The past two years with US mid-term elections have been poor years for risk assets (2018 and 2022), we would not be surprised if that were the case in 2026. The off-year elections last month in the US indicated that many voters are unhappy with the political status quo which has generally been quite market friendly. A populist and leftward turn for congress seems more likely than not, which would not help the current market narrative.

We believe that valuations are a much more important predictor of future returns than where we are in a US presidential cycle, and there is little valuation support for broad indices in both equities and credit markets today. Despite some volatility in recent weeks, from what we can see there still is a heavy dose of speculation in securities prices today. Some areas of note are equities exposed to AI, quantum computing and electric vehicle manufacturing where declining demand and a weakening outlook has been met with higher prices in stocks like Tesla (Nasdaq: TSLA) and Rivian (Nasdaq: RIVN), both of which appear to be supported by retail investors.

Portfolio Metrics

The Fund finished November with long positions of 131.4% (excluding cash and T-bills). 33.6% of these positions are in our Current Income strategy, 95.4% in Relative Value and 2.4% in Event Driven positions. The Fund had a -62.1% short exposure that included –3.6% in government bonds, -38.1% in credit and –20.4% in equities. The Option Adjusted Duration was 1.86 years.

Excluding positions that trade at spreads of more than 500bp and positions that trade to call or maturity dates that are 2027 and earlier, Option Adjusted Duration declined to 1.38 years.

The Fund’s current yield was 6.82% while yield to maturity was 6.76%.

Justin Jacobsen, CFA

December 17, 2025

1 All Pender performance data points are for Class F of the Fund unless otherwise stated. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Liquid Alternative Funds may be found here: https://penderfund.com/fund/pender-alternative-absolute-return-fund/