VANCOUVER, B.C., February 6, 2026 - PenderFund Capital Management Ltd. (“Pender”) is pleased to announce that two of its funds were awarded a FundGrade A+ Award at the ‘Evening of Excellence’ ceremony in Toronto on February 5, 2026.

Le Fonds alternatif d’actions sélect Pender et Fonds d’obligations de sociétés Pender were both winners. This is the first time that one of Pender’s liquid alternative funds has been recognized. This is the seventh time that the Pender Corporate Bond Fund has been honoured with this award.

The FundGrade A+ award is designed to identify and grade funds demonstrating consistent outperformance on a risk-adjusted basis, with a methodology [1] that is completely quantitative. Funds are assessed monthly using a range of metrics against peers.

“Thank you to Fundata for the recognition, especially in a volatile year that behaved differently from recent markets”, said Greg Taylor, Chief Investment Officer and Portfolio Manager of the Pender Alternative Select Equity Fund. “The Fund is designed to capitalize on volatility through active trading, and that approach proved effective last year.”

“We’re honoured to receive this award, which reflects our team’s disciplined investment process and commitment to delivering strong, consistent performance by uncovering compelling opportunities in the credit markets”, stated Lead Portfolio Manager, Fixed Income, Geoff Castle. “This recognition is also a testament to the clients who understand and support our differentiated approach to managing the fund.”

About the Pender Alternative Select Equity Fund

The Pender Alternative Select Equity Fund focuses on North American equities, targeting excess returns with less volatility. The Fund is adaptable to all market conditions with an active sector-rotating strategy based on investment themes. The Fund manages beta and equity exposure enhancing risk management through active trading, short selling, cash management and option overlays. More information and standard performance data for the Fund may be found here: https://penderfund.com/fund/pender-alternative-select-equity-fund/

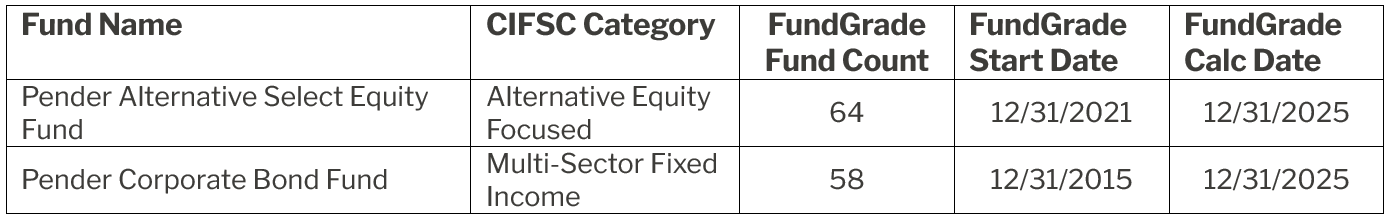

Pender Alternative Select Equity Fund was recognized for outstanding fund performance at the 2025 Fundata FundGrade A+® Awards in the Alternative Equity Focused category out of a total of 64 funds. Performance for Class F of the fund for the period ended December 31, 2025 is as follows: 40.2% (1 year), 22.3% (3 years) and 13.7% (since inception- August 2021).

About the Pender Corporate Bond Fund

The Pender Corporate Bond Fund is an income fund that is both conservatively managed to preserve capital, as well as opportunistic to generate returns. The Fund is focused on key credit characteristics – coverage, seniority and duration. It is driven by bottom-up fundamental analysis, the Fund seeks to use its nimble size to invest in opportunities large or index-based funds cannot. This advantage could provide investors with an attractive cash yield, while maintaining positions in attractively valued securities that provide a margin-of-safety for investors. More information and standard performance data for the Fund may be found here: https://penderfund.com/fund/pender-corporate-bond-fund/

Pender Corporate Bond Fund was recognized for outstanding fund performance at the 2025 Fundata FundGrade A+® Awards in the Multi-Sector Fixed Income category out of a total of 58 funds. Performance for Class F of the fund for the period ended December 31, 2025 is as follows: 13.4% (1 year), 12.7% (3 years), 8.4% (5 years), 9.2% (10 years) and 7.1% (since inception- June 2014).

Au sujet de Gestion de capital PenderFund ltée

Pender, société indépendante appartenant à ses employés, a été établie en 2003 à Vancouver, en Colombie-Britannique. Son objectif consiste à protéger et à faire fructifier le patrimoine de ses investisseurs au fil du temps. Forte de son équipe talentueuse composée d’experts dans l’analyse, la sélection des titres et la recherche indépendante, Pender gère activement sa gamme de fonds de placement en exploitant les inefficacités du marché afin de réaliser ses objectifs. Veuillez visiter www.penderfund.com/fr.

Veuillez lire les avis de non-responsabilité importants à www.penderfund.com/fr/disclaimer/

Au sujet de la notation FundGrande A+® de Fundata Canada Inc.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

Pour plus de renseignements, veuillez communiquer avec :

Melanie Moore

Vice-présidente du marketing, Gestion de capital PenderFund ltée

mmoore@penderfund.com

(604) 688-1511

Sans frais : (866) 377-4743

[1] Methodology: https://assets.fundata.com/FundataFundgradeMethodology.pdf