Contexte boursier actuel

Octobre a été un mois marquant pour les marchés des États-Unis. Cela a commencé par la paralysie budgétaire du gouvernement dont la durée a surpassé celle, record, de 35 jours de 2019. Bien que cette fermeture ait eu des conséquences directes et indirectes sur l’ensemble de l’économie des États-Unis, le marché boursier a peu réagi. Les investisseurs sont restés concentrés sur les rendements des entreprises et sur les développements en matière de politique monétaire.

La Réserve fédérale a réduit les taux de 25 points de base. Elle a aussi annoncé qu’elle mettait fin à ses mesures de resserrement quantitatif. Le président Powell a toutefois souligné qu’il ne fallait pas en déduire qu’il y aurait une autre réduction en décembre. Par conséquent, les marchés fondent désormais leur évaluation sur un allégement de 17 points de base en décembre, et non plus de 25 points comme ils s’attendaient avant la rencontre.

En octobre, les marchés bousiers des États-Unis ont continué de monter comme ils le font depuis plusieurs mois déjà, cette fois encore entraînés par la croissance des grandes entreprises des secteurs de la technologie et de la consommation discrétionnaire. Les petites entreprises ont livré des rendements variés, tandis que les moyennes entreprises ont terminé le mois en territoire légèrement négatif. Les bénéfices des sociétés ont été généralement robustes et la plupart des « 7 magnifiques » ont surpris de manière positive.

L’une des grandes thématiques du mois a été l’accélération des dépenses d’investissement des fournisseurs à grande échelle de services infonuagiques. À la vue des résultats financiers, on prévoit que les dépenses d’investissement réalisées en trésorerie en 2025 par les 11 plus grands de ces fournisseurs totaliseront 469 milliards $ .1Cela représente un rehaussement de 68 % d’une année sur l’autre, ou de quatre points de pourcentage (ou de 11 milliards $) depuis le début de la saison des résultats du T3. Ces révisions majorées sont principalement attribuables à Amazon, Meta et Alphabet. Elles témoignent de l’incessante augmentation des investissements dans les structures de l’IA.

Comme l’usage de l’IA continue de se répandre, les besoins en matière de traitement des données s’accélèrent à une vitesse exponentielle, et les revenus tirés du nuage informatique tendent à monter. Pour leur part, les centres de données attirent de plus en plus d’investissements, et les fournisseurs de composants bénéficient de l’explosion de la demande et d’une visibilité accrue. Collectivement, ces facteurs exigent des grands fournisseurs de services infonuagiques qu’ils relèvent sans cesse leurs dépenses d’investissement. À preuve, les dépenses mondiales pour les infrastructures en IA progressent vers une cible annuelle de 3 à 4 billions $, comme l’a récemment souligné le PDG de Nvidia, Jensen Huang.

Dans ce contexte, nombre des « 7 magnifiques » et des fournisseurs de la technologie sous-jacente à l’aménagement de ces infrastructures ont vu leurs titres atteindre des sommets en octobre et devancer de beaucoup ceux des secteurs peu exposés à l’hégémonie de l’IA.

Nous croyons que les revenus d’entreprise solides conjugués à une politique monétaire plus modérée et à la multiplication des investissements en IA continueront d’offrir un soutien appréciable aux actions.

Rendement

Avec sa modeste avancée de +0,47 %, l’indice S&P MidCap 400 a pour ainsi dire fait du surplace en octobre. Cette hausse médiocre met en évidence la faible performance des sociétés à moyenne capitalisation par rapport au S&P 500 qui, lui, a progressé de +2,34 %. Depuis le début de l’année, les moyennes entreprises se sont relevées de 4,12 %, gain qui est largement devancé par celui de +16,77 % du S&P 500. Cette différence a élargi les écarts de valeur et ouvert un point d’entrée intéressant dans la sphère des moyennes entreprises. Le S&P 400 se négocie à un ratio cours/bénéfices prévisionnel de 16,4 x contre celui de ~23,5× pour le S&P 500, ce qui représente un escompte de 7,1. Aux investisseurs à long terme qui, comme nous, tiennent compte des données fondamentales, cet écart grandissant donne l’occasion d’investir dans d’excellentes entreprises en pleine croissance dont le prix est attrayant.

Mise à jour sur le Fonds

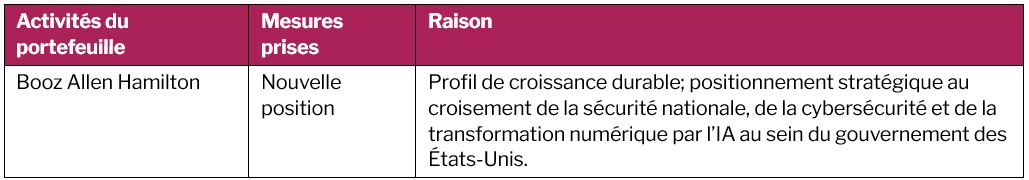

Nous avons créé une position dans Booz Allen Hamilton (BAH)L’entreprise fournit des technologies de pointe aux États-Unis qui les mettent au service de leurs priorités en matière de défense et de sécurité civile et nationale. L’offre de l’entreprise s’étend à la défense nationale, à la cybersécurité, à la protection des infrastructures et à la modernisation numérique. Elle a pour but d’aider les gouvernements et les organisations à fonctionner plus efficacement et de façon plus sécuritaire. Forte de sa vaste expérience en IA, en cybersécurité et en ingénierie, Booz Allen livre des solutions technologiques de pointe. Grâce à son investissement constant dans un personnel de grande qualité, à ses partenaires et à ses modèles d’affaires innovants, l’entreprise prend tous les moyens pour assurer l’excellence et la durabilité de sa croissance.

Ses derniers résultats ont révélé un certain ralentissement temporaire qui, selon nous, est favorable à l’achat. Nous croyons que l’entreprise est bien placée pour connaître une croissance durable à mesure que la transformation numérique gagnera le secteur public.

Nous avons fondé notre participation sur le fait que Booz Allen est l’un des principaux fournisseurs de services en cybersécurité et en IA auprès du gouvernement. De plus, l’entreprise s’intéresse à la transformation numérique, à l’espace et aux technologies émergentes, sans compter qu’elle entretient de solides relations avec le département de la Défense, le renseignement et les agences civiles. La taille de l’entreprise, son expertise technique et ses effectifs accrédités sur le plan de la sécurité lui apportent un avantage concurrentiel incomparable. Selon nous, Booz Allen est un investissement hautement rentable qui correspond parfaitement aux principes d’investissement de Pender — c’est-à-dire posséder des entreprises au lieu de nous contenter de négocier des actifs, et chercher à produire une valeur à long terme grâce à une exécution disciplinée.

Au cours du mois, nous avons aussi élagué et vendu certains actifs et redistribué le capital ainsi obtenu dans des occasions qui nous inspirent confiance et qui devraient bientôt tirer profit de catalyseurs plus vigoureux.

Perspectives

Nous pensons que le contexte actuel demeure avantageux pour le Fonds d’actions américaines à petite/moyenne capitalisation Pender. Quant à ce que l’avenir nous réserve, la volatilité liée aux taux d’intérêt, l’évolution de la situation géopolitique et l’humeur changeante des investisseurs vont sans doute perdurer, créant ainsi un climat positif pour des investissements ascendants soigneusement choisis. Une telle conjoncture offre souvent aux investisseurs patients, attachés aux données fondamentales, l’occasion de découvrir des entreprises ayant un bon bilan, un flux de trésorerie fiable et une valeur avantagée par des catalyseurs.

Notre objectif ne change pas : livrer une croissance à long terme du capital en trouvant des actifs mal évalués dans divers secteurs et régions, en nous appuyant sur la recherche fondamentale approfondie de Pender et sur une approche privilégiant les actifs dans lesquels nous avons une forte confiance.

Aman Budhwar, CFA

Novembre 12, 2025

[1] Morgan Stanley Report, 3 novembre 2025