As we find ourselves in December, with the holiday season upon us, the question naturally arises: Do you believe in the Santa Rally?

This seasonal phenomenon, where equities tend to rise in the run-up to Christmas, is one of the market’s most enduring traditions. Across geographies and market cycles, the pattern persists: according to recent analysis the FTSE 100 has delivered a positive December return in 24 of the past 30 years, while the S&P 500 has risen 22 times. This trend survived the financial crisis, Brexit, and the COVID-19 pandemic. History suggests that December is often one of the most rewarding months to be invested. But as we head into 2026, we can’t help but ask— is it time to put our Santa Rally caps on, or will markets take a more measured path into year-end? While history leans in favour of strength, we remain focused on fundamentals as we navigate what could be the final chapter in an eventful year.

In November, global equity markets grew increasingly cautious as signs of stretched valuations prompted a shift away from mega-cap Technology stocks toward more defensive sectors such as Healthcare and Consumer Staples. Broader macroeconomic uncertainty remained in the background, but investor focus remained on how high-growth segments might adjust to evolving interest-rate expectations and moderating earnings momentum. Tech valuations, particularly among AI-linked companies, were again at the forefront of investor minds. Even a positive earnings report from Nvidia only briefly calmed concerns before questions resurfaced about sustainability and concentration risk.

This backdrop reinforces the case for diversification, and not just across regions. In our view, it also strengthens the opportunity to own high-quality companies trading at compelling valuations. Businesses with durable competitive advantages, consistent earnings growth and prudent balance sheets continue to look attractively priced relative to many parts of the global market. Environments like this tend to favour active managers who are willing to do the work and take advantage of the dispersion that often emerges as markets recalibrate. With uncertainty still elevated in the near term, particularly around tariffs and broader trade policy, our disciplined focus remains on the enduring themes that underpin our investment process.

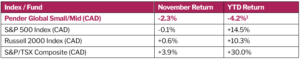

Portfolio weights remain roughly 63.3% Canadian equities, 32.3% US equities. The Fund saw notable contributions from certain holdings especially in Materials, Financials and Industrials.

Mise à jour sur le Fonds

Although the Fund underperformed its benchmarks in November, we remain confident in our strategy and continue to see attractive opportunities in our holdings.

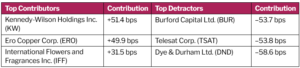

Kennedy-Wilson Holdings was the top performer in the month after receiving an all-cash acquisition proposal at $10.25/sh from a consortium led by CEO William J. McMorrow and Fairfax Financial Holdings. The offer represents roughly a 38% premium to KW’s previous close. In response, Kennedy-Wilson’s board has formed a special committee of independent directors to evaluate the offer and pursue other potential acquirers, which could lead to a higher competing bid.

Ero Copper was another top performer, benefiting from renewed positive sentiment across the mining sector. In its November Q3 results, the company highlighted continued improvement in throughput rates at its second copper-producing asset, Tucumã. Ero maintains a solid copper growth profile, underpinned by supportive long-term copper market fundamentals.

Burford was a detractor this month, as third-quarter results came in compared with the same quarter last year, with revenue falling sharply and the company reporting a net loss. Its long-running investment in the Argentina-YPF litigation—stemming from claims over Argentina’s 2012 renationalization of YPF—continues to draw attention, with an appellate court decision expected within the next year.

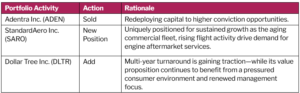

We added to our position in Dollar Tree one of the largest value-focused retailers in North America, as early signs of its multi-year turnaround continue to show through in results. Dollar Tree remains a barometer for low- to middle-income consumer health. Recent results indicate that while wallet pressure persists, consumers are prioritizing essentials and seeking value—a dynamic that has historically benefitted Dollar Tree during periods of economic uncertainty.

We initiated a new position in StandardAero the world’s largest independent provider of aerospace engine aftermarket services. We believe that the company is well-positioned for sustained growth. Global flight activity is rising while the commercial fleet continues to age — now averaging ~12 years vs. ~10 years in the early 2010s. Slower-than-expected OEM deliveries are extending aircraft life and increasing demand for maintenance, while deferred COVID-era maintenance is now coming due. SARO plays a critical role between OEMs and operators, holding exclusive or semi-exclusive licenses with several engine manufacturers and maintaining a century-long reputation for safety, reliability and performance.

David Barr

17 décembre 2025

1 All Pender performance data points are for Class F of the Fund. Other classes are available. Fees and performance may differ in those other classes. Standard Performance Information for Pender’s Equity Funds may be found here: https://penderfund.com/fund/pender-global-small-mid-cap-equity-fund/.