Le rideau tombe sur 2025 et pour mettre fin à la représentation, les marchés font leur salut avec la certitude que, peu importe les péripéties qui ont mené à cet aboutissement, le « spectacle est maintenant terminé ». L’année s’est en grande partie déroulée selon le scénario espéré des optimistes. Les attentes ont été dépassées, la résilience a été éprouvée et avérée, et les investisseurs ont été amplement récompensés. Dans de tels moments, on se prend à désirer éperdument un rappel — encore un acte, un seul, avant que les projecteurs s’éteignent et que la scène se vide. Comme le conseille Shakespeare : « Allons sagement et doucement : trébuche qui court vite. »

L’année a mis en scène plusieurs situations de tentation, mais aucune n’a été plus remarquable que celle montrant l’engouement suscité par l’intelligence artificielle. Le capital s’est rapidement envolé dans l’espace, le discours a pris de l’ampleur et, sur le marché, quelques titres ont volé la vedette alors que les investisseurs s’engouffraient dans la petite loge réservée à quelques rares acteurs considérés comme les plus populaires. Bien que l’IA possède un évident potentiel transformateur, la vitesse et la concentration des gains invitent à établir une comparaison avec des périodes d’excès, dont celle de la bulle technologique.

Cela dit, à notre avis, nous n’en sommes qu’au premier acte de la révolution de l’IA et loin encore de la tombée du rideau. Son utilisation en est encore à ses débuts, le nombre d’entreprises qui l’emploient et les revenus qu’elle génère commencent à peine à augmenter. Tout ceci doit nous porter à adopter une posture constructive — mais sélective — envers les titres liés à l’IA, particulièrement envers les entreprises qui affichent une véritable croissance en matière de revenus, possèdent des plateformes appelées à se développer et jouissent d’une exposition aux infrastructures et aux strates à la base de l’écosystème.

Jusqu’à présent, les modèles de base et les infrastructures infonuagiques ont accaparé les manchettes. Or, la prochaine vague d’occasions commence à apparaître dans des sphères comme l’IA agentique et l’IA physique, y compris les véhicules autonomes, la robotique et l’automatisation industrielle. Néanmoins, la discipline est de mise. Pour citer de nouveau Shakespeare : « Tout ce qui brille n’est pas de l’or. » Notre objectif est de distinguer les entreprises qui dureront de celles qui suscitent un enthousiasme passager.

Au-delà de la technologie, la métaphore s’applique, littéralement, à la ressource qui a occupé le devant de la scène, l’or ayant été l’un des grands gagnants de l’année. Soutenu par l’incertitude géopolitique, les préoccupations sur le plan de l’inflation et l’intérêt renouvelé pour les actifs concrets, le secteur a livré des gains appréciables. Or, même dans ce cas — où ce qui brille est bel et bien de l’or —, l’augmentation rapide du prix souligne l’importance d’être discipliné et sélectif quant à la valeur.

Alors que l’attention se tourne vers l’année qui vient, les actions internationales méritent de plus en plus d’être prises en considération. Les actions états-uniennes ne figurent pas parmi les plus brillantes de 2025; les hauts faits des actions internationales ont été grandement sous-estimés. Bien que les exploits passés ne soient pas garants des rendements futurs, et que l’histoire nous offre maints exemples d’acteurs qui se sont attardés trop longtemps sous les projecteurs, cette pièce de théâtre est loin d’être terminée. Pour notre part, nous estimons que des raisons convaincantes expliquent pourquoi les actions internationales voleront encore la vedette en 2026. Par opposition aux secteurs très achalandés qui ont défini l’essentiel de 2025, nous croyons que les marchés mondiaux offrent un éventail plus large d’entreprises dont les fondamentaux, les bilans et la distribution disciplinée du capital l’emportent encore. Les banques centrales des marchés émergents, ayant renforcé le cadre de leur politique monétaire, disposent désormais de plus de latitude pour assouplir leur politique et stimuler la demande intérieure, conditions susceptibles de soutenir les actions des marchés émergents.

Au cours de l’année à venir, le nombre d’acteurs risque fort de s’élargir. Il n’est pas nécessaire que le leadership soit assumé uniquement par une poignée de noms connus ou de marchés, et nous croyons qu’on pourra trouver de plus en plus d’occasions ailleurs que sur les scènes les plus courues. En adoptant un point de vue plus large, nous augmentons la possibilité d’identifier des entreprises dont le scénario est encore en cours d’écriture et dont la valeur, et non le narratif, est à l’origine de gains à long terme. En ce sens, Shakespeare nous rappelle :

« Le monde entier est un théâtre,

et les hommes et les femmes ne sont que des acteurs. »

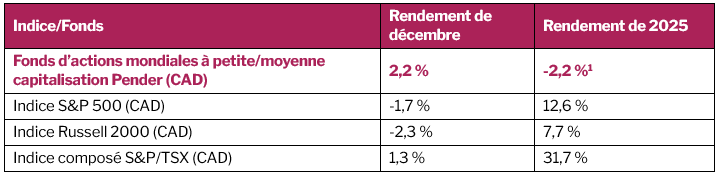

Les pondérations en portefeuille sont les mêmes : environ 55,8 % dans les actions canadiennes et 39,9 % dans les actions états-uniennes.

Mise à jour sur le Fonds

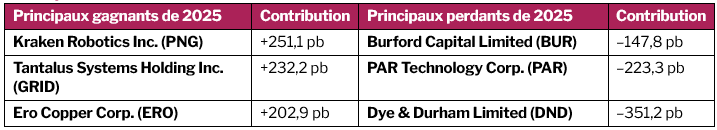

Les grands gagnants du Fonds ont livré de bons résultats. Ils forment le noyau de notre portefeuille et figurent parmi nos dix principaux actifs. De plus, chacune de ces entreprises est associée à des thèmes qui devraient, selon nous, attirer davantage d’attention en 2026.

Par exemple, Ero Copper est une entreprise brésilienne exploitant des mines de cuivre et d’or qui a tiré profit de l’engouement pour les métaux en 2025, lequel a été soutenu par la demande structurelle en matière de transition énergétique, les investissements en infrastructures et l’approvisionnement restreint sur le marché du cuivre.

Du côté des perdants, Burford Capital, PAR Technology et Dye & Durham ont pesé sur les rendements cette année, surtout parce qu’elles ont fait face à des défis d’exécution et à la grande incertitude des investisseurs sur le court terme.

En ce qui a trait plus particulièrement à Dye & Durham, 2025 ne s’est pas déroulé comme nous l’anticipions. Après une année de turbulence dans la salle du conseil en 2024, Engine Capital a remporté la course aux procurations et un nouveau conseil d’administration a été nommé. Pendant tout ce temps, ces développements nous ont paru positifs en raison du potentiel de Dye & Durham de générer un important flux de trésorerie disponible et de la nécessité d’améliorer la distribution du capital. Mais nous n’avions pas anticipé à quel point 2025 apporterait plus de défis que de solutions. Le délai prolongé des audits, la surveillance réglementaire accrue et l’avènement d’un processus axé sur les ventes stratégiques ont préoccupé les investisseurs tout au long de l’année, contribuant à la piètre performance des actions et détournant l’attention du rendement global du Fonds.

Bien que l’histoire de Dye & Durham n’ait pas connu le dénouement que nous espérions, soulignons que le Fonds a commencé 2025 fort d’une année 2024 particulièrement satisfaisante (en hausse de 56,1 %), ce qui a placé la barre haut. La composition générale du portefeuille et la qualité de nos actifs continuent de nous inspirer confiance, même si certains peuvent parfois traverser une zone de turbulence.

David Barr, CFA

19 janvier 2026

1 Tous les rendements signalés sont ceux des parts de catégorie F du Fonds. D’autres catégories de parts sont offertes. Celles-ci pourraient présenter des frais et des rendements différents. Les données standards sur le rendement du Fonds sont présentées ici https://penderfund.com/fr/fund/pender-global-small-mid-cap-equity-fund/