Pender Strategic Growth & Income Fund – Managers Commentary – January 2020

The Pender Strategic Growth & Income Fund had a modest start to 2020 with F Class units of the Fund returning 1.10%.

The fixed income portion of the Fund (Pender Corporate Bond Fund, Class O) returned 0.32% (40.6% weight), the small cap allocation portion of the Fund (Pender Small Cap Opportunities Fund, Class O) returned 3.84% (5.5% weight) while the remainder of the returns came by way of the segregated equities holdings.

Fixed Income

The Pender Corporate Bond Fund (“PCBF”) had a modestly positive month in January, as an early year rally in wider spread credits faded towards the end of the month with investors focusing on the risks related to coronavirus, amongst other issues.

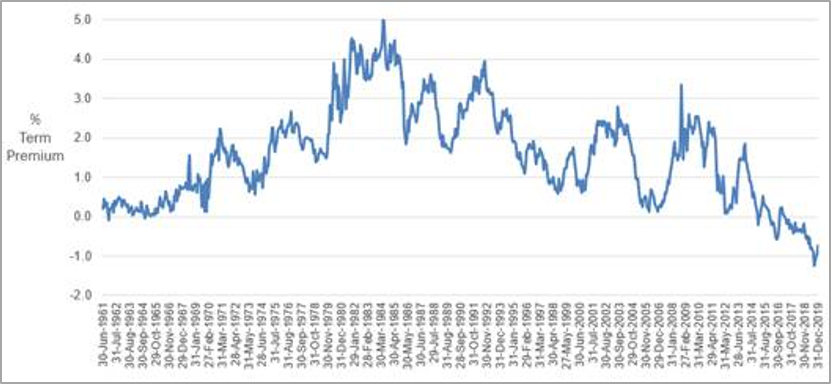

In recent years, the US 10-year Term Premium, or the extra economic yield investors receive for accepting longer duration exposure, has fallen below zero on the US 10-year bond. With this in mind, the portfolio manager is aiming to keep the duration on the PCBF short. At the end of January 2020 it was 2.8 years.

Source: Federal Reserve Bank of NY

Source: Federal Reserve Bank of NY

Segregated Equity – Winning again with WYNN

Wynn Resorts, an operator of luxury resorts in the US and China, held a 2.3% weight in the Fund at the beginning of 2020. The stock had been one of the Fund’s top performers in 2019 and still looked promising going forward as the impact from the US/China trade war was finally easing. However, the outlook suddenly worsened in January. With the rapid spread of the Coronavirus, officials in the city of Macau requested the closure of its 41 casinos for two weeks to try to contain the coronavirus outbreak. That included Wynn-owned resorts. We believed that conditions could go from bad to worse and that the shut down could be further extended to contain the outbreak. Historically, the stock has been sensitive to changes in visitation levels to Macau as almost two-thirds of Wynn’s intrinsic value is based on its operations in China. As a result, we believed the stock was becoming increasingly vulnerable to a short-term hit. We exited the position over the course of two weeks in late January to early February.

This recent sale of WYNN is a good example of our risk mitigation framework which takes the emotion out of making the decision of when to sell:

- When the facts change

- When our thesis is wrong

- When we have better ideas

- When an idea becomes overvalued

In this case, no matter how promising the stock looked in early January, the facts changed, and we sold.

WYNN has been a lucrative idea for Pender. This was the second time we had bought and subsequently sold a position in WYNN, both as a result of the facts materially changing. We first bought WYNN in late 2015 in the Pender Value Fund. Our due diligence showed us this was a high-quality company, trading below intrinsic value after the stock had been crushed due to fears that a China anti-corruption drive would lower visitations to Macau on a permanent basis. We purchased the stock during this dip and when visitors came roaring back, the business enjoyed a multi-year run. But then the facts changed. In early 2018, serious sexual misconduct allegations surfaced against founder, Steve Wynn. While not speculating on the allegations, we did not want to risk giving up those gains in a worst-case scenario. We sold the entire position, booking a 2.6x return over our cost during our holding period. This time around WYNN generated an attractive total return of 37%, including the 4% annualized dividend yield, over our cost, during our holding period of about 13 months. Although the return was not as strong as the first time, it exceeded our expectations nevertheless.

Source: Bigcharts, Pender

Source: Bigcharts, Pender

Key: PVF – Pender Value Fund; SGI – Pender Strategic Growth & Income Fund; PUSF Pender US All Cap Equity Fund

The Longer View

We look forward to 2020 and beyond as we continue to research more compelling market opportunities and address the realities of the current market cycle. For conservative investors seeking balanced mandates, it makes sense to be more cautious after an extended business cycle. However, being cautious does not necessarily mean they should own fixed income securities with negative or extremely low yields. Nor does it mean they should increasingly favour those very stocks with the highest valuations. Yet, that is happening in many cases.

The reality of the current market equity cycle is that capital being invested into passive instruments is largely momentum and growth driven. It is also megacap and large cap-centric, because those are the only equity capital pools large enough to absorb valuation-agnostic fund inflows on such a massive scale. Another reality that investors have learned is that you can’t ignore or fight the machines too hard, especially in the short term.

In a world where US market capitalization has been one of the highest correlated factors to outperformance, fundamental analysis has appeared outdated and largely unnecessary. This trend has been ongoing for many years now. Just look at the fund flows. The crowd is expecting more of the same and betting on the same trade. Not surprisingly, valuation discrepancies between the very largest and most liquid stocks listed in the major indices compared to stocks trading outside of those indices continue to widen. It is almost certain that this can’t go on indefinitely. We are leaning in a different way.

In a world where US market capitalization has been one of the highest correlated factors to outperformance, fundamental analysis has appeared outdated and largely unnecessary. This trend has been ongoing for many years now. Just look at the fund flows. The crowd is expecting more of the same and betting on the same trade. Not surprisingly, valuation discrepancies between the very largest and most liquid stocks listed in the major indices compared to stocks trading outside of those indices continue to widen. It is almost certain that this can’t go on indefinitely. We are leaning in a different way.

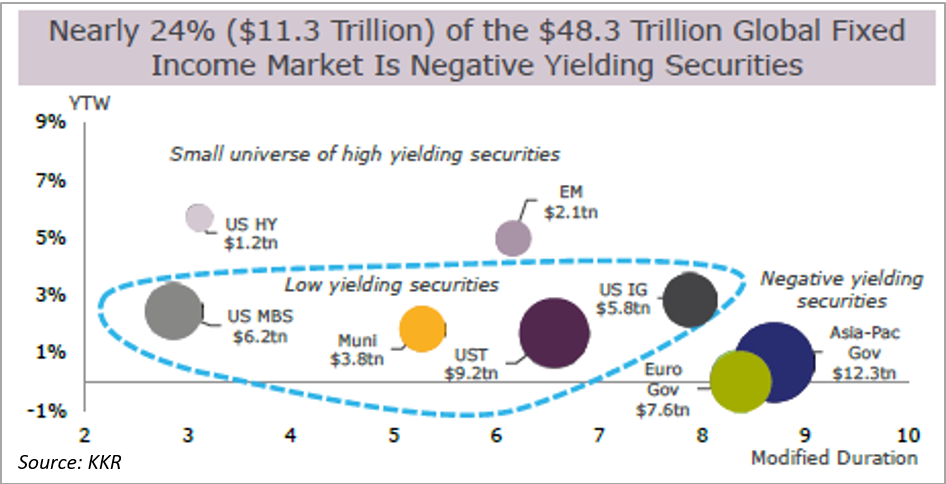

We don’t believe a S&P500 centric equity weighting that is “balanced” with today’s mix of negative-to-low yielding bonds representative of the global fixed income market is a favourable set up for the future. (Judging by fund flows, we are clearly in the minority here!). When you do as everyone else does, don’t be surprised when you get what everyone else gets. Over the past year, we sold the four megacaps and the one Canadian bank previously held in the Fund, as well as a number of other fully valued large caps holdings after their big runs. Simply put, we believe the opportunity set has become increasingly compelling in smaller-sized companies. We shifted strategy to provide greater emphasis on undervalued small and mid caps with growing cash flows, higher dividend yields and upside potential for capital growth. As noted in our December update, the Fund also almost doubled its historic fixed income weighting in the Pender Corporate Bond Fund last year, to increase exposure to the attractive US high yield market, in order to provide higher income and dampen volatility. As a result of these changes, the income profile of the Fund is notably higher than historically.

At a minimum, we believe the Fund is uniquely positioned compared to most other Balanced mandates as a potential diversifier, because its asset exposure is very different than most other Funds in the category. Alternatively, if you share our view, and believe everything is cyclical and nothing works indefinitely, then shifting your strategy ahead of the crowd at the late stages of the market cycles makes some sense. We may well be early, but we believe there is truth in the saying, “What the wise do in the beginning, fools do in the end”.

Please do not hesitate to contact me should you have questions or comments you wish to share with us.

Felix Narhi

February 14, 2020