Manager’s Quarterly Commentary – David Barr – Q3 2014 – Pender Value Fund

Canadian and US markets were relatively flat during the quarter and the Fund performed similarly. The Fund returned 1.10%1 compared to the benchmark2 returning 2.81%. Returns were predominantly currency gains for both the Fund and the index. Nobilis Health Corp (formerly Northstar Healthcare) was a top contributor to the Fund this quarter.

1 Refers to Class A units in the Fund.

2 50% S&P/TSX Capped Composite Total Return Index, 50% S&P 500

Liberty Interactive: Unwrapping Value

We routinely mention how “special situations” can offer compelling return characteristics. Special situations are investments that are based on the outcome of an event such a spin-out, reorganization, merger etc. Although each situation is quite different, they tend to share return characteristics that can be quite advantageous to the long term performance of a portfolio. Two such return characteristics are:

- A return profile that is uncorrelated to the overall market.

- A timeline for the investment that can be reasonably estimated.

Warren Buffett spoke about these two characteristics of special situations (which he calls “workouts”) in his 1965 letter to shareholders, “However, the predictability coupled with a short holding period produces quite decent average annual rates of return after allowance for the occasional substantial loss.”

Our recent position in Liberty Interactive offers an example of how these special situations can play out over the course of the investment holding period. In October 2013, management of Liberty Interactive publically announced their plans to spin-out a group of e-commerce companies. We initiated our position in Liberty Interactive (NYSE: LINT.A) in mid-June 2014, knowing the planned spin-out was near to complete. Pre-spin Liberty Interactive consisted of two distinct segments:

- A home shopping network segment, including QVC and interests in the Home Shopping Network.

- A group of niche e-commerce companies, including companies such as backcountry.com, bodybuilding.com and evite.com.

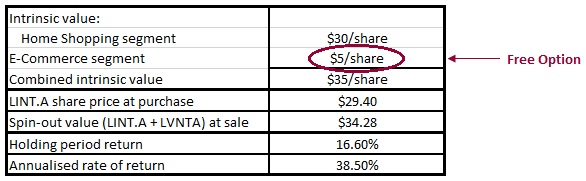

Pre-spin we valued Liberty Interactive without the e-commerce segment at $30/share, and with the e-commerce segment near $35/share. When the Fund was able to initiate a position in June 2014 at $29.40/share, the e-commerce segment was, in our opinion, bought for free. On October 20, 2014 the spin-out completed and, by way of special dividend, for every share of Liberty Interactive the Fund owned we received a portion of another share, Liberty Ventures (NYSE:LVNTA). Most importantly, when we closed our position at the beginning of December 2014, the $29.40/share position had a comparable share price of $34.28. A 16.6% return may seem decent in its own right, but because our holding period was less than six months, the 16.6% gross return translates into an annualized return of 38.5%.

It is our belief that over the long term, a company’s share price will align with its intrinsic value. Special situations can often offer the market a catalyst to quicken this alignment. To answer the inevitable question of why this occurs, a gift-wrapped present comes to mind. Financial statements are the wrapping by which we may judge the enclosed present of intrinsic value. Depending on the corporate structure of the company, this financial wrapping varies in transparency. Although the wrapping is usually relatively transparent, at other times it may shroud the underlying gift in opaqueness. Spin-outs as a catalyst often increase transparency, offering the inquisitive investor every child’s pre-Christmas wish — a sneak peek into the gift he or she shall inevitably receive.

Portfolio Updates

The Fund initiated two new positions and exited another two positions during the quarter. In addition, we actively increased weightings in three companies and deceased our weightings in one company. The top holdings of the Fund saw some movement as two new names entered our top five holdings, and five entered our top ten. The Canadian exposure of the fund was increased slightly to 47.20% from 43.91% last quarter.

David Barr

December 8, 2014