Pender Strategic Growth & Income Fund – Managers Commentary – December 2019

The Pender Strategic Growth and Income Fund returned 1.6% in December 2019 and for the full year returned 18.5%[1]. The Fund finished a top decile performer in its Morningstar category in 2019[2].

2019 was a year of change for the Fund as it navigated some challenging markets. We started the year with a stock market rebound during the first four months after a sharp decline in equity values in the fourth quarter of 2018. This was followed by sideways movement in global equities and then a downturn in the late summer as investors became fearful due to the growing negative global yields in the bond market. In the fourth quarter, markets rallied once again after the ongoing trade war between the US and China appeared to be de-escalating.

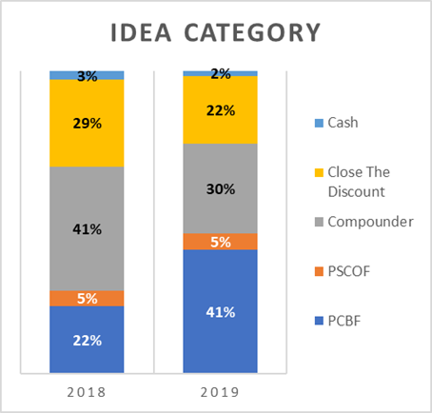

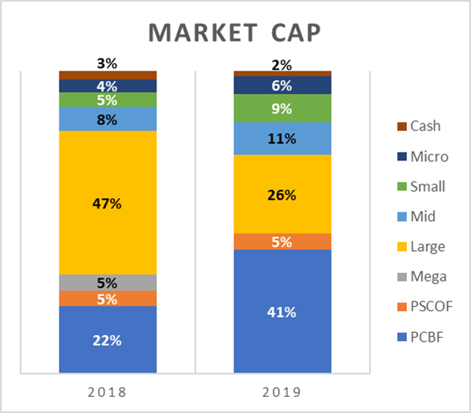

The market rally at the beginning of 2019 gave us time to reflect and complete a post-mortem on what worked and what didn’t for the Fund through 2018’s market volatility. The Fund ended 2018 with 22% exposure to the Pender Corporate Bond Fund, 5% in the Pender Small Cap Opportunities Fund, and the remaining in mainly mega and large cap companies. The volatility experienced in 2018 was an experience we were not eager to repeat for a conservatively managed balanced fund.

Through this process, we identified some changes aimed to increase income and dampen volatility, while still providing attractive risk-adjusted return potential.

A few of the changes made:

- Increased Fixed Income Exposure

- We have almost doubled the historic weighting in the Pender Corporate Bond Fund

- Provides lower volatility and higher income

- Top quartile and award-winning Fund under Geoff Castle’s management

- Target a 30-60% weight depending on market conditions

- We have almost doubled the historic weighting in the Pender Corporate Bond Fund

- Decreased average market cap

- Greater focus on “mini blue chips”

- Market exuberance with mega and large cap stocks has driven greater valuation discrepancies, relative to the small-to mid cap opportunity set

- Higher dividend yields and upside potential from undervalued small and mid cap stocks with growing cash flows and dividends will be favoured

- Hired accomplished small cap equity income-focused PM, Don Walker who specializes in “mini-blue chips”, or smaller firms with strong businesses in defendable niches trading at attractive valuations.

- Greater focus on “mini blue chips”

- Chose dividends outside the index

- Value added alternative to increasingly crowded index-linked strategies

- Best ideas from the Pender investment team, with low overlap to major indices to provide investor diversification from typical Canadian balanced funds

- Entire Fund is bottom-up selected, based on a value-oriented and total return approach

- Uncapped weight to the Pender Small Cap Opportunities Fund (target of 5-10%)

- Value added alternative to increasingly crowded index-linked strategies

At December 31, 2019. Source: Pender

After these changes were implemented during the first half of 2019, we saw increased success for the Fund in the form of lower downside volatility with stronger returns. We look forward to 2020 and beyond, and believe we have found a formula that will work for investors who are seeking income, with some capital growth and a buffer to market volatility.

Please do not hesitate to contact me should you have questions or comments you wish to share with us.

Felix Narhi

January 21, 2020

[1] F Class

For full standard performance information, please visit: http://www.penderfund.com/funds

[2] Source: Morningstar.ca; Category: Canada Fund Global Equity Balanced