Manager’s Quarterly Commentary – David Barr – Q2 2013

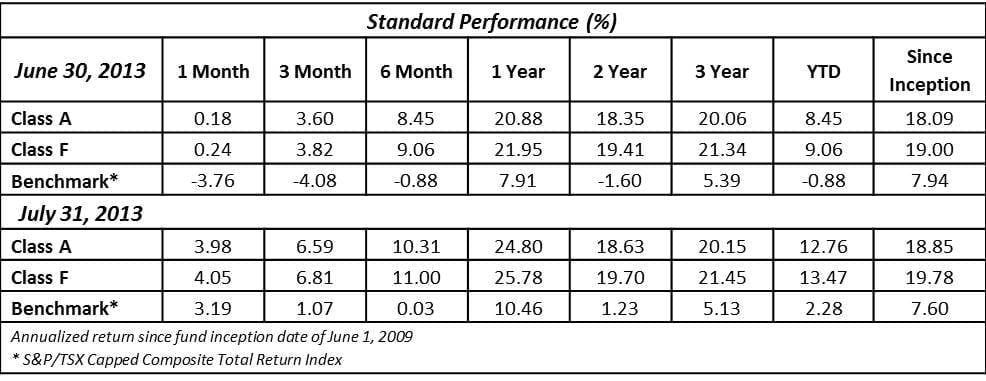

Following up on the Fund’s strong performance in 2012, your Fund1 was up 8.45%1 in the second quarter compared to -0.88% for the benchmark. Last year, the Fund’s performance was assisted by several of the underlying companies being acquired by third parties. So far this year, the performance of the Fund has been driven by some of the largest positions in the fund, namely Absolute Software, Ag Junction and Sierra Wireless. Since inception2 the Fund has an annualized return of 18.09%1, compared to 7.94% for the S&P/TSX Capped Composite Total Return Index.

1 Refers to Class A units in the Fund.

2 Inception is June 2009.

A Value Investor in a Growth Investor World

One of the most interesting areas where we find opportunities is growth companies trading at a price only a value investor would love. How does this come about? When companies go public, in particular technology companies, they usually generate very high expectations about the growth prospects of the company. When these assumptions are built on limited operating history and little competition, it can be easy to generate a lofty valuation for a company early in its lifecycle.

As we all know, things change. Companies experience growing pains, competition intensifies and reality sets in. Executing on a business strategy is always more challenging than writing one down on paper. As a value investor, when these hiccups occur, we get excited. Because expectations were so high to begin with, the growth investors become impatient and the stock overcorrects on the downside. Companies in this situation, that have a solid business and a strong management team, provide us with the opportunity to become shareholders at a very attractive price.

Portfolio Updates

With solid performance in the first half of the year, we took the opportunity to exit four positions this quarter. Three companies were sold as the valuation raced through our estimate of intrinsic value and one company was sold when it was acquired.

Despite these exits, we decreased the cash position of the fund from 21% to 17%. We acted opportunistically to buy three new holdings and to add to existing holdings that were cheap. At the end of Q2, the portfolio was well positioned as we have been able to add to our top ten holdings at or around current market prices.

David Barr

June 30, 2013