Manager’s Commentary – David Barr – Q4 2018

Fellow Unitholders,

Happy New Year. Or should I say good riddance to 2018. Either way, it’s that time of year when we reflect on the previous year. What we can say is that last year sucked with respect to stock price movements.

The preordained outcome of big drawdowns in the stock market is that people are looking for answers. When stock markets are going up, everyone knows the reason, it’s the result of our intelligence and skill. The search for answers in down markets brings out the brigade of talking heads – economic forecasters with big ideas. I recently shared an article on social media from Frank K. Martin CFA titled “Tell Me What I Wanna Hear” talking about these “Hedgehogs”.

We saw a lot of these same types of people in 2009 and 2010, in and around the financial crisis. Why is this? People want an answer. A concrete explanation makes them feel better. The problem is, nobody knows the reasons markets do what they do on a day-to-day, week-to-week or year-to-year basis. At our weekly investment team research meeting, when asked about a company, security or business, my most common answer is “it depends”. The reality is that the world is neither black nor white, but a shade of gray. Maddeningly frustrating for those looking for a definitive answer!

In hindsight, people will zoom in on one or two lightning rod issues to explain the downturn but the reality is something completely different. Stock markets are complex adaptive systems. The study of biological systems is more likely to provide a better understanding of markets than the study of economic variables. In a complex adaptive system, multiple variables or inputs will influence the outcome. The greatest challenge is understanding the impact of these variables as they influence one another. The system is dynamic and changes, leading to an uncertain future – the system itself changes the outcome.

So with that, I will stop pontificating on macro events. That’s not to say we do not look at the economy. A strong economy creates tailwinds improving the outlook for different industries and companies while a weak economy creates headwinds. Even more importantly, a strong or weak economy can influence the appetite for market participation. A strong economy can produce an over priced market and a weak economy can create a cheap market.

Considering these kinds of market forces comes into our security selection and for now we are bullish. Why?

- Today’s negative sentiment

- Top down small to mid cap valuations look bullish

- Bottom up view also looks bullish

1. As a contrarian, today’s negative sentiment is a bullish indicator

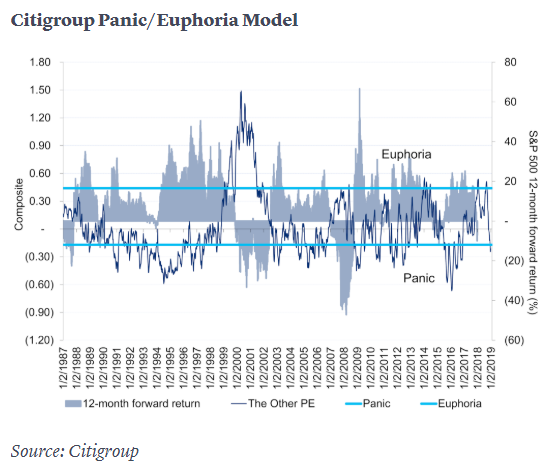

When investors are panicking, like they are today, prospective returns are usually much better. According to Citigroup, markets are “officially” panicking and in a state of extreme fear, based on their Panic/Euphoria model on January 2, 2019. This is great news on a forward-looking basis. “This indicates “high probabilities of making money (with average 18% upward moves looking out 12 months)”.”1 This model is based on various indicators and has a “good track record of predicting pullbacks and surges”. At times like this it’s all about temperament not analytics, and we believe that forced and panic selling today, generate pent up returns for tomorrow.

1 https://www.cnbc.com/2019/01/02/investors-are-officially-panicking-citigroup-says.html

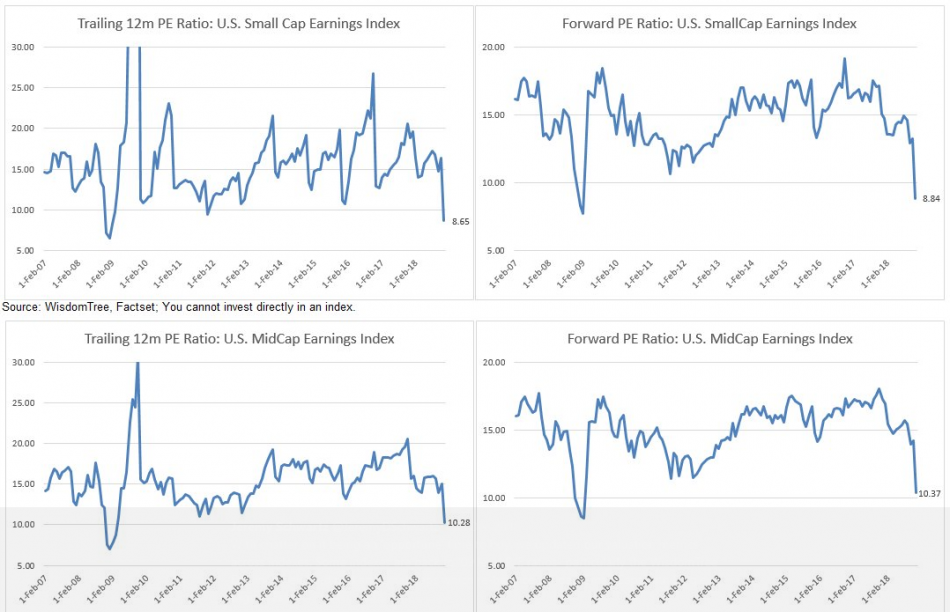

2. The top down valuation view looks bullish, especially for small-to-mid cap stocks vs. large cap focused S&P500

Small and mid-cap stocks have not been this cheap since the huge market correction in 2009. That was a great time to be bullish. We believe the same is true today. Stock prices are going nowhere but these small and mid cap companies are increasing their intrinsic value every day, and we’ve been adding them to the portfolio. The Pender Value Fund now has much higher exposure to small-and-mid cap companies that are listed outside the large cap indices.

Small and mid-cap stocks have not been this cheap since the huge market correction in 2009. That was a great time to be bullish. We believe the same is true today. Stock prices are going nowhere but these small and mid cap companies are increasing their intrinsic value every day, and we’ve been adding them to the portfolio. The Pender Value Fund now has much higher exposure to small-and-mid cap companies that are listed outside the large cap indices.

Source: WisdomTree, Factset

3. The bottom up view looks bullish too

We believe the portfolio, in aggregate, offers compelling value. We will not disclose our internal intrinsic value estimate ranges on every holding, but looking at the historical trading ranges of PVF’s top 10 names provides some clues to how attractively valued the portfolio currently is. Historically, we have used cash as a strategic asset class. We have deployed cash when markets correct, because the opportunity set widens and bargain prices in companies that we understand becomes more plentiful. Following the recent market correction, we are now essentially fully invested, which historically has been a great time to own the Fund. Based on our models, we believe that today, in aggregate, the Fund is at one of its most attractive valuation levels since its inception.

David Barr

January 22, 2019

For full standard performance information, please visit: http://www.penderfund.com/funds/