Manager’s Commentary – Q2 2019 – David Barr

Fellow Unitholders,

We are happy to report that both the Pender Value and Pender Small Cap Opportunities Funds had positive quarters. The Pender Value Fund was up 5.5%[1] and the Pender Small Cap Opportunities Fund was up 1.6%1. For the half year ending June 30, both Funds coincidentally returned 15.3%1.

If stocks are expensive, someone forgot to tell small caps!

Our funds have started the year off well, as have the large cap indexes. Generally, when our portfolios increase in value, you will see us start to build up cash as the margin of safety in the companies we own decreases. So far this year, a lot of our performance can be attributed to the larger compounders in the portfolio or catalysts in our small cap portfolio. What we have not seen is a broad-based rebound in the small cap world. If we look at the small cap indexes, we are in fact still down from 12 months ago and in the case of microcaps, down double digits[2].

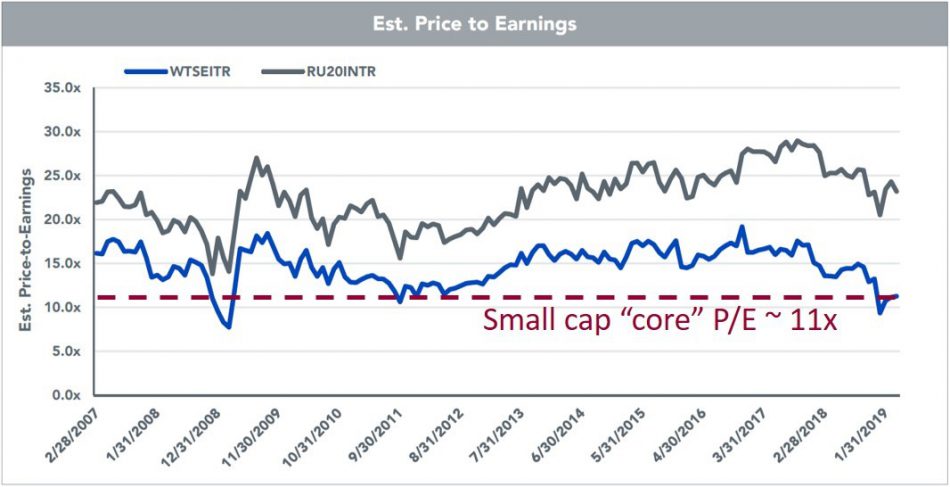

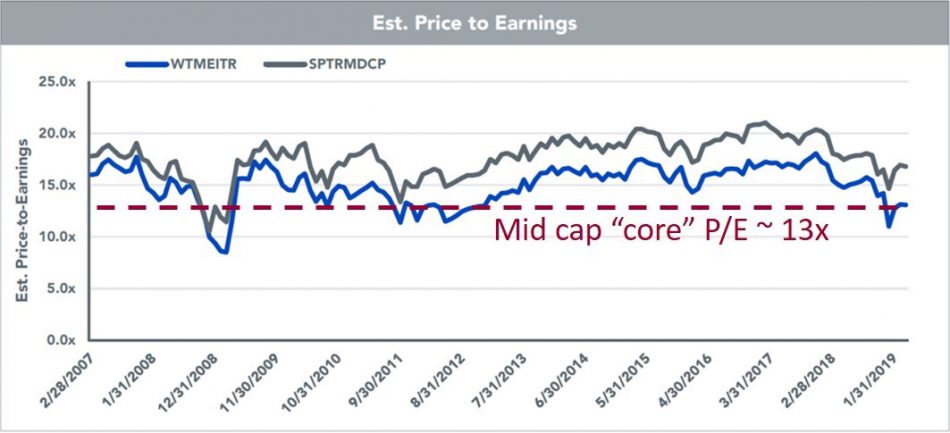

As we know, stock prices don’t always represent business value as multiples expand and contract with the current sentiment of the market. As I write this the trailing P/E ratio of the large cap S&P 500 is 19.9x[3]. When you look at the Russell 2000, its P/E ratio currently stands at almost 40x3 (!). But not all indexes are created equal. The vast majority of companies in the S&P500 are profitable, but that is not the case in the widely cited small cap Russell 2000 index. Of note, the Russell 2000 has many smaller development stage companies (no revenue and losing lots of money, for example some Biotech firms). These companies serve to increase the PE multiple of the index as a whole and a distorted comparison relative to profitable larger companies. We have been following the WisdomTree US Small Cap Index which takes out all of these unprofitable companies, resulting in what we see in the charts below. When viewed through the lens of core profitability, both small and mid cap stocks are trading at very attractive valuations, at 11x and 13x respectively.

We have historically invested in small caps as market inefficiencies allows us to find undervalued or mispriced companies. On top of that, small cap companies can have growth rates that exceed the economy and potentially have many years of such growth ahead of them if they are in the early innings of tapping into a large target market. We currently find ourselves in a target rich environment.

Portfolio Updates

For both the Pender Value and Pender Small Cap Opportunities Funds, returns were largely driven by the performance of key holdings, including Air Transat (TSX: TRZ) and Maxar Technologies (TSX: MAXR), with the assistance of one takeover in the quarter, BSM Technologies (TSX: GPS). Our view is that Transat still has some upside potential from here as there is the meaningful possibility of a superior offer. For Maxar, liquidity and risk profile are improving, with high reward potential post anticipated asset sales and contract wins. BSM Wireless was a nice win for both funds as Geotab bought it for $1.40 in April 2019.

Key detractors for the Pender Value Fund included large cap companies such as Baidu (NASDAQ: BIDU), SS&C Technologies (NASDAQ: SSNC) and TripAdvisor (NASDAQ: TRIP).

Meanwhile, key detractors for the Pender Small Cap Opportunities Fund included Canadian small cap / microcap companies such as Medicure (TSXV: MPH), Indigo Books & Music Inc. (TSX: IDG) and Athabasca Oil Corporation (TSX: ATH).

Since our investment thesis for all of these companies remains intact, our margin of safety has increased and so has our potential return.

For both funds, cash was in single digits as of June 30, 2019, well below our historical average. We have been deploying cash as we see opportunities where there is a disconnect between intrinsic value and market price, with an emphasis in rotating our portfolio into higher quality companies.

David Barr, CFA

July 16, 2019

[1] Refers to Class F units in the Fund. Source: Pender

[2] 10.6%, Russell Microcap Index, CAD, June 30, 2019, Source: Bloomberg

[3] At July 15, 2019. Source: Bloomberg