Something to tell your grandkids about one day…It’s official: The S&P500 is now in the longest bull run in history.

Of note, the S&P500 is also in one of the oldest bull markets globally. Virtually every other major market has had a +20% correction at some point in the same period. In related news, the top three most valuable companies in the S&P500 – Apple, Amazon and Alphabet (AAA or S&P3) – are collectively worth more than ALL the companies listed in the TSX. At the recent pace, perhaps the top two AA’s will be worth more than the TSX soon!

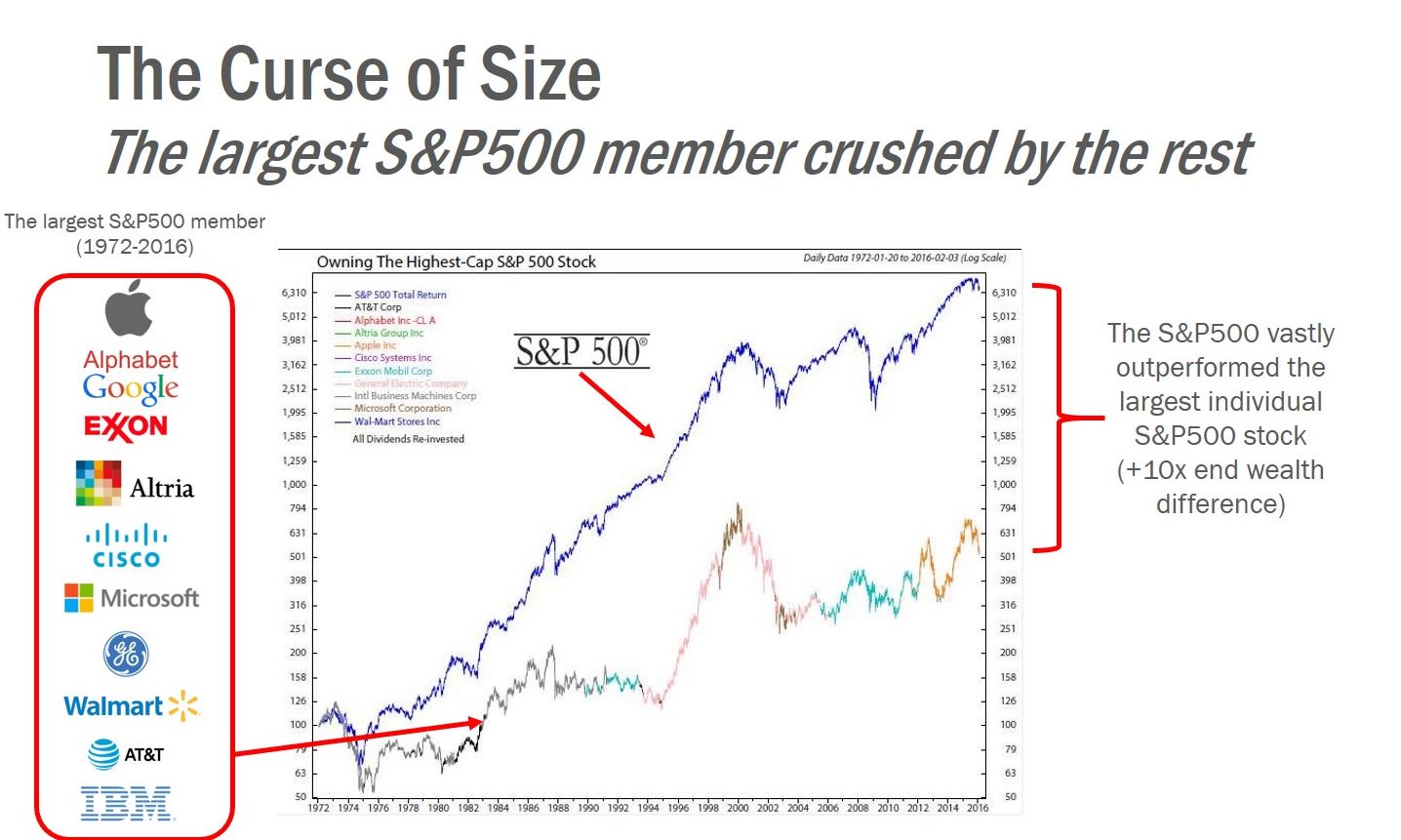

I’m so old, I remember when Nortel was “worth” 35% of the TSX (which was called the TSE300 back then) and was ten times larger than the next largest company. Fans of megacaps, stay tuned! Kidding aside, owning the highest cap S&P500 stock may not be the surest path to investment nirvana, as shown in the long-term chart below of the massive underperformance of the single highest cap S&P stock vs S&P500. (From a historical perspective, we recently opined that we are open to the idea that it’s different this time. But everything has its limits.)

The Curse of Size: The largest S&P500 member crushed by the rest

Source: Ned Davis and Pender

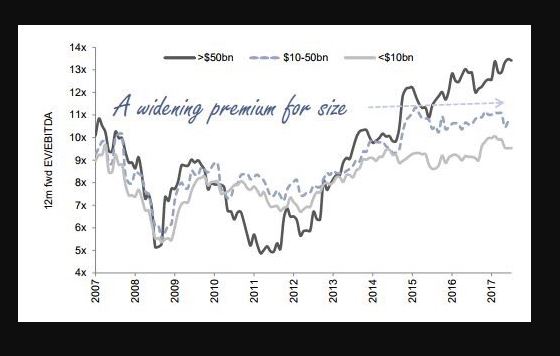

The top 48 firms now account for half of the S&500’s total market value. There has been a widening valuation premium for size which has pushed up the very largest stocks and set the pace for the S&P500. Investors are clearly enamored with megacaps. For those that believe this is the new normal, it’s important to keep in mind that just about everything is cyclical, as shown in the chart below. Indefinite multiple expansion is NOT a sustainable component of total returns over the long run. Question to ponder: Is the valuation megacap discount from 2011 almost closed?

Source: @PlanMaestro

What does this S&P500 milestone mean for Pender?

Not much. With Active Share scores at more than 90%, most of Pender’s Funds are idiosyncratic and very different from the major indices. That’s just the way we like it. We try to keep investor Howard Marks’ advice in mind, “The safest and most potentially profitable thing is to buy something when no one likes it.” In addition, we like ideas that are mostly undiscovered and under-the-radar for most investors (and we hope others discover them shortly thereafter!). To sum up, we continue to seek ideas amongst the unloved, underappreciated and misunderstood. We have also learned from experience that tomorrow’s prospects will be different, and often superior, to today’s opportunity set. In the absence of good ideas, holding cash is a sensible default fall back option, so we can be ready when opportunity knocks.

Felix Narhi

August 22, 2018